Some internet wandering led me to stumble on the following chart from PWC that left me a little dumbfounded, and prompted a stroll through some IPO facts and figures.

Who in their right minds would try to get their business listed on a stock exchange in the middle of a pandemic, and potentially in the teeth of a terrible recession? It turns out that 477 businesses did just that in Q3 this year, raising $116bn in the process.

According to EY “Q3 2020 was the most active third quarter in last 20 years by proceeds and the second highest third quarter by deal numbers”.

So where is this extravaganza of new listings? 23 of them turned up in London (details here at the LSE). The fun was mostly being had in the US. They were flying off the shelves at such a rate that the numbers are increasing by the day it seems. As of 24th November, 2020, according to stockanalysis.com: "There have been 401 IPOs on the US stock market this year, as of November 24, 2020. That is +81.4% more than the same time in 2019, which had 221 IPOs by this date."

Is there a spooky correlation between the number of people dying from respiratory illness and the volume of IPOs during the year? One for Tyler Vigen maybe...

Looking at that busy US IPO activity for 2019, (as at November 2020) 59% of the IPOs are higher than their initial listing price, 40% are lower. The top 10 are below:

|

IPO Date |

Name |

IPO Price |

Current |

Return |

|

Apr 18, 2019 |

Zoom Video

Communications |

$36.00 |

$430.28 |

1095% |

|

Jun 13, 2019 |

Fiverr

International |

$21.00 |

$200.00 |

852% |

|

Oct 10, 2019 |

BioNTech SE |

$15.00 |

$106.50 |

610% |

|

Nov 21, 2019 |

SiTime |

$13.00 |

$85.20 |

555% |

|

Jun 28, 2019 |

Karuna

Therapeutics |

$16.00 |

$100.00 |

525% |

|

Jun 6, 2019 |

GSX Techedu |

$10.50 |

$63.90 |

509% |

|

Mar 7, 2019 |

ShockWave

Medical |

$17.00 |

$98.64 |

480% |

|

Apr 17, 2019 |

Turning Point

Therapeutics |

$18.00 |

$104.37 |

480% |

|

May 2, 2019 |

Beyond Meat |

$25.00 |

$140.96 |

464% |

|

Dec 5, 2019 |

LMP

Automotive Holdings |

$5.00 |

$27.71 |

454% |

The bottom 10 from 2019:

|

IPO Date |

Name |

IPO Price |

Current |

Return |

|

Nov 8, 2019 |

ECMOHO

Limited |

$10.00 |

$1.43 |

-86% |

|

Aug 15, 2019 |

9F Inc. |

$9.50 |

$1.29 |

-86% |

|

Feb 12, 2019 |

Anchiano

Therapeutics |

$11.50 |

$1.41 |

-88% |

|

Nov 13, 2019 |

YayYo |

$4.00 |

$0.4500 |

-89% |

|

Feb 15, 2019 |

Stealth

BioTherapeutics |

$12.00 |

$1.30 |

-89% |

|

Jul 31, 2019 |

Borr Drilling |

$9.30 |

$0.800 |

-91% |

|

Jan 4, 2019 |

China SXT

Pharmaceuticals |

$4.00 |

$0.290 |

-93% |

|

Apr 5, 2019 |

Guardion

Health Sciences |

$4.00 |

$0.247 |

-94% |

|

May 10, 2019 |

Sonim

Technologies |

$11.00 |

$0.585 |

-95% |

|

Aug 1, 2019 |

Sundial

Growers |

$13.00 |

$0.241 |

-98% |

2020 has been just as exciting. 61% of the new listing from this year are in the green, whilst 36% have lost money.

2020 top 10 IPOs:

|

IPO Date |

Name |

IPO Price |

Current |

Return |

|

Aug 14, 2020 |

CureVac |

$16.00 |

$85.06 |

432% |

|

Aug 27, 2020 |

XPeng |

$15.00 |

$72.17 |

381% |

|

Apr 8, 2020 |

Keros

Therapeutics |

$16.00 |

$76.21 |

376% |

|

Jul 17, 2020 |

ALX Oncology

Holdings |

$19.00 |

$82.28 |

333% |

|

Feb 6, 2020 |

Schrodinger |

$17.00 |

$67.65 |

298% |

|

Jul 30, 2020 |

Li Auto |

$11.50 |

$43.64 |

279% |

|

Jul 17, 2020 |

Berkeley

Lights |

$22.00 |

$83.36 |

279% |

|

May 22, 2020 |

Inari Medical |

$19.00 |

$68.00 |

258% |

|

Jun 5, 2020 |

Dada Nexus |

$16.00 |

$52.03 |

225% |

|

Aug 13, 2020 |

KE Holdings |

$20.00 |

$62.97 |

215% |

And the bottom 10:

|

IPO Date |

Name |

IPO Price |

Current |

Return |

|

Feb 6, 2020 |

Casper Sleep |

$12.00 |

$6.04 |

-50% |

|

Jan 17, 2020 |

Velocity

Financial |

$13.00 |

$6.25 |

-52% |

|

Sep 30, 2020 |

Boqii Holding |

$10.00 |

$4.78 |

-52% |

|

Feb 13, 2020 |

Muscle Maker |

$5.00 |

$2.30 |

-54% |

|

Feb 24, 2020 |

Zhongchao |

$4.00 |

$1.82 |

-55% |

|

Jan 30, 2020 |

AnPac

Bio-Medical Science |

$12.00 |

$3.49 |

-71% |

|

Jan 17, 2020 |

Phoenix Tree

Holdings |

$13.50 |

$3.76 |

-72% |

|

Jun 19, 2020 |

Progenity |

$15.00 |

$3.64 |

-76% |

|

Jan 17, 2020 |

Lizhi Inc. |

$11.00 |

$2.48 |

-77% |

|

Jun 30, 2020 |

Aditx

Therapeutics |

$9.00 |

$1.91 |

-79% |

Exciting stuff, a bit racy for me.

The requirements for a new listing vary slightly from one exchange to another, as do the regulatory requirements. The LSE have a nice write up here and nicely summarised below.

It all sounds like a nice wheeze to get some cash, perhaps the founders have the chance to offload some of their own investment tied up in the company. But a more sobering element is the cost. PWC again have a nice tool to allow a view of the potential costs.

As an example, a tech firm with revenues less than $100m wanting to list at a valuation in the range of $100m to $250m would end up having to hand over between $8m to $24m according to PWC.

Some of these IPOs are SPACs - Special Purpose Acquisition Companies. There is a detailed and comprehensive write up from Harvard if these excite you. SPACs are companies with no commercial operations that are designed and built just to raise capital via an IPO. It then buys an existing business. They are known as "blank cheque" companies and have been around for decades, but the recent boom in IPOs have brought these to the public attention through some high profile listings.

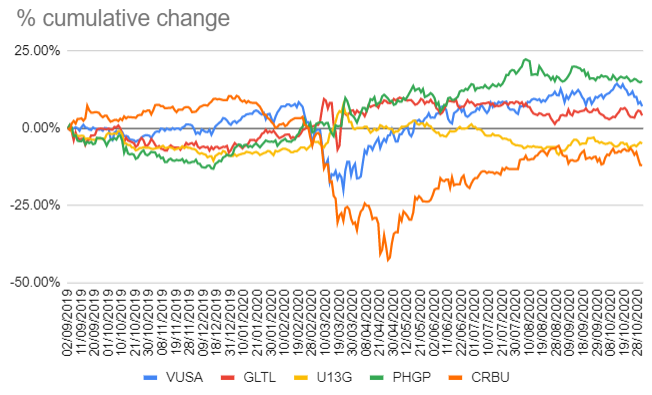

I think IPOs are not for me, although one or two of the US businesses do look interesting. I prefer my investments to be a little less volatile.