Long term goals

My investment goals posted at the start of last year were modest, but realistic:

- Don’t lose money

- Increase capital by more than the rate of inflation

- Build a conservative dividend paying portfolio

And I would also wanted to beat the UK stock market, as measured through the FTSE All Share. The reason for this final ambition was simply one of risk vs. reward. If I was unable to beat an index fund by picking individual stocks, then I should buy the index fund as this would provide better reward for (arguably) less risk (see my post on index funds for more thoughts on this).

The above long term goals are fine I believe, and do not need to change. However, I think they do need more detail which is below:

Don't lose money.

Hopefully self explanatory...

Increase capital by more than the rate of inflation.

The price of the shares that I own is going to fluctuate, but over the long term, if I have invested in quality businesses they should increase in value. So long as they increase in value faster than inflation, should I decide to sell them, I will end up with more money than I started with - in real terms. Perhaps an unambitious goal, but very much linked to the first one above.

Build a conservative dividend paying portfolio.

This is the key goal for me, as I want to use this investment to generate income in the future. I want the portfolio to have a relatively low level of volatility, and to be consistently paying dividends, and for those dividends to be growing. The dividend growth will be partly organic - through the businesses in which I'm invested growing their dividends, and I will continue to increase the amount invested to also increase the dividend return.

Not every investment will be dividend focused. If I notice an interesting business, that is attractively priced, I may invest - but these will generally form the smaller, non-core elements of the portfolio.

The price of the shares that I own is going to fluctuate, but over the long term, if I have invested in quality businesses they should increase in value. So long as they increase in value faster than inflation, should I decide to sell them, I will end up with more money than I started with - in real terms. Perhaps an unambitious goal, but very much linked to the first one above.

Build a conservative dividend paying portfolio.

This is the key goal for me, as I want to use this investment to generate income in the future. I want the portfolio to have a relatively low level of volatility, and to be consistently paying dividends, and for those dividends to be growing. The dividend growth will be partly organic - through the businesses in which I'm invested growing their dividends, and I will continue to increase the amount invested to also increase the dividend return.

Not every investment will be dividend focused. If I notice an interesting business, that is attractively priced, I may invest - but these will generally form the smaller, non-core elements of the portfolio.

Goals for 2020

The shorter term goals for 2020 are unexciting, which is essentially to do more of the same. Investing in quality, low risk businesses that pay dividends.

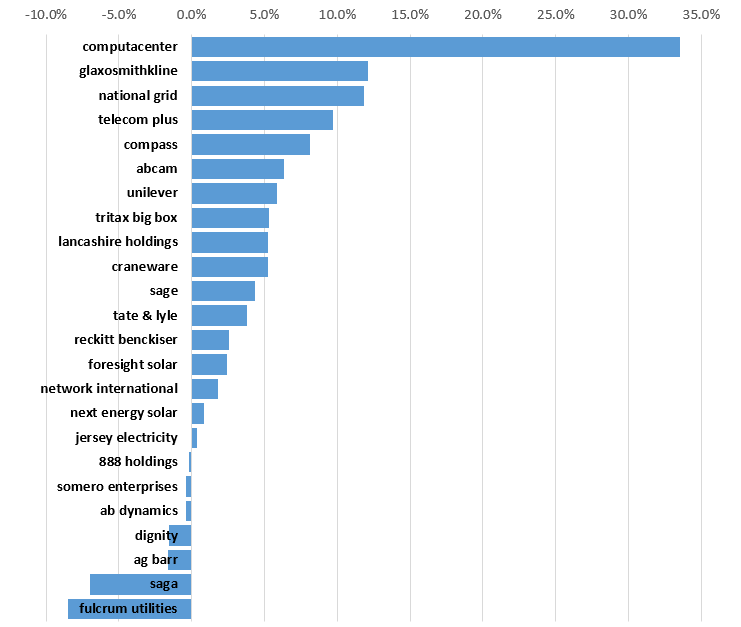

My strategy for the upcoming year is to continue to build a low risk portfolio of dividend paying stocks. As at the start of January 2020 I am invested in 24 businesses but only around 12 of those I consider to be core holdings. I would rather continue to diversify before building the existing core holdings. Some of the small positions I have I will add to if the prices are appropriate, others I will keep as smaller holdings as I think they have greater risk. I would like to get to around 30 core investments with roughly equal amounts invested into each. I will continue to search out lower risk businesses that look to have certain indications of quality - high returns on capital, good margins, good cashflow, and preferably low debts. The portfolio will continue to maintain larger holdings in relatively low risk investments, with a few small racier positions to complement them.

Selling activity is likely to be limited, but if the business no longer meets my investment criteria it will leave the portfolio. As a result the portfolio churn will hopefully be minimal.

Valuations

I have also considered what value my portfolio might be and what dividends it should pay at the point that I decide to retire. Perhaps surprisingly the value is of lesser concern, I have plotted a path on the chart below which indicates an annual growth rate of 8% which is just over the total return of the FTSE All Share for the past 10 years. This doesn't seem to be an unrealistic target but time will tell if I'm able to keep up.

Of greater concern are the following:

- rate of investment

- dividend payments

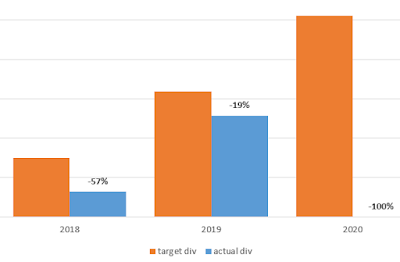

If I want the portfolio to generate income, then I need to pay attention to dividends. They need to be sustainable over the long term, the businesses in which I invest should have demonstrated that they can manage their capital sensibly and are not forced to cut dividend payments, and they should return a dividend that increases over time.

This is deeply connected to my ability to increase the amount invested in my portfolio. I can't control the prices and movements in the underlying value of the portfolio. Nor can I control the capital allocation decisions made by the management of the companies in which I'm invested - so I don't control the dividends either. However, I can choose to invest each month, and will track my progress of this against a realistic target. Although I can't control them, I can model dividend income based on a few assumptions, such as suggested here. Assuming I continue to invest I can model the potential increases in dividend payment as the following:

- If the dividends paid on my investments increase by 2.5% each year then my retirement portfolio will receive in dividends the same amount I intend to invest each year. In other words at the point of retirement the portfolio would still grow at the same rate but without any additional funding from me, it would happen entirely through dividends.

- If the dividends increased by 10% each year, then my retirement portfolio would pay out annually 2.5x the amount I am investing.

So in the 2.5% increase scenario, if I invested £10k per year, at retirement in 20 years, my portfolio would pay out £10k in dividends each year.

In the 10% increase scenario, if I invested £10k per year, at retirement in 20 years, my portfolio would pay out £25k in dividends each year.