Solar power has been a phenomenal success. It's increasing adoption is driving down costs, and generating increasingly cheap electricity. Here is an article that spells this out in convincing detail.

This article from the IEA is suggestive of something similar, although from the point of view of auctions. And this from Irena, suggesting the costs from Solar have been reducing by around 13% per year.

I think the greatest impediment to further

adoption of renewables over fossil fuel has been economics. It seems clear that in the case of solar this argument has been won. Solar provides increasingly cheap, cost effective electricity.

I have two investments in solar power in my portfolio, Next Energy Solar Fund (NESF) and Foresight Solar Fund (FSFL). In both cases I assumed these would offer relatively little in the way of capital growth, but that the pedestrian growth will be augmented by a steady flow of dividends. And since the power that these businesses generate gradually increases in price over time, the dividends will more or less keep pace with that level of price inflation.

However, as noted above, solar energy price inflation may not be forthcoming. Quite the opposite. Next Energy Solar recently published their annual report so I was intrigued to read about how they intend to manage a product reducing in price.

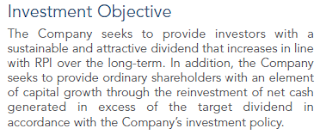

I bought shares in Next Energy Solar Fund (NESF) in November 2019, essentially buying into their investment objective as outlined in their 2019 annual report:

I expected it would reduce the volatility of my portfolio, as it should have steady revenue streams, most of which were backed by Government subsidy. And one reason I like dividends is that they too help reduce portfolio volatility. So it was a typical risk/ reward trade off - lower growth and lower volatility. The KIID implied as much.

At the time 35% - 40% of NESF revenue was not covered by some form of subsidy, and more subsidy free solar development was underway. So this chunk of subsidy free electricity would be subject to the movement of prices on the wider wholesale energy market.

The annual report describes the fund's NAV increasing over 2019 for various reasons, including "...upwards revisions in the forecasts for long-term power prices...". Happy days, unless those power prices go the other way...

I like reading annual reports - it is the chance for the business to put itself in the shop window, and tell the best version of it's story. It is also a more rounded story, with a little more meat than the simple results briefing. It should be convincing, so when it isn't I find it worrisome.

The NESF results weren't great, but not disastrous. NAV down a bit, dividends up a bit. Operationally there were more assets generating more electricity, and a higher capacity. But the Chairman's statement contained the following:

"...power prices and inflation levels have become less correlated..." - which rather matches some of the analysis from the articles linked above. And as a result RPI linked dividends are out of the window, the resulting change to NESF's investment objective has since become "regular dividends":

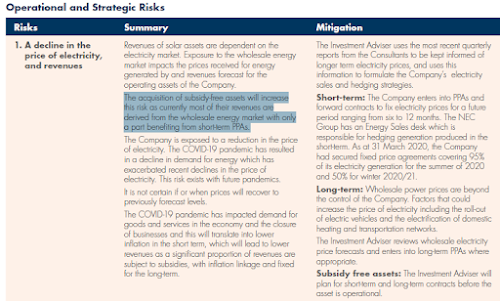

The top "Operational and Strategic Risk" highlighted in the annual report relates to the risk of falling electricity prices: "The acquisition of subsidy-free assets will increase this risk as currently most of their revenues are derived from the wholesale energy market with only a part benefiting from short-term PPAs."

The Chairman acknowledges that 39% of their revenues are without subsidy, and require locking in prices using PPAs:

And that they continue to pursue a subsidy free investment programme, aiming for 150MW by the end of 2020, at a cost of £55m - £80m. Preference shares worth £100m were issued during the year, which I guess is the source of the majority of this cash.

The final bit of irritation was found in their financial KPIs,