Investment

goals:

- Don’t lose money

- Increase capital by more than the rate of inflation

- Build a conservative dividend paying portfolio

My specific benchmark is the Vanguard FTSE All Share (Accumulation) tracker.

Portfolio

performance

During

2019 the portfolio has

increased in value by 23.6%. This

compares to an increase of 19% in my benchmark.

Total return

FTSE All Share Tracker

|

Portfolio

|

|

2018

|

-9.6%

|

1.6%

|

2019

|

19%

|

23.6%

|

Compound

Annual Growth Rate

FTSE All Share Tracker

|

Portfolio

|

|

2018

|

-9.6%

|

1.6%

|

2019

|

3.7%

|

12.1%

|

Dividend

yield

At

the end of the year the dividend yields of both benchmark and portfolio were

the following:

All Share Tracker yield: 4.08%

Portfolio 2019 trailing yield: 2.5%

Portfolio total yield from January 2018: 3.1%

Of the portfolio growth, 85% was from capital, 15% from dividends.

Portfolio 2019 trailing yield: 2.5%

Portfolio total yield from January 2018: 3.1%

Of the portfolio growth, 85% was from capital, 15% from dividends.

In summary, I'm pleased at the portfolio performance over the year, but most markets across the globe were on an upwards trend after a significant sell off during Q4 2018. I think a good chunk of positive sentiment was a recovery from that sell off. In the UK specifically we had Brexit to contend with, and the election of the Conservatives with a large majority helped to clarify the path forward for this a little. Since we won't have the same positives buoying the markets in 2020, and we have heightened expectations after a good run in 2019 it wouldn't surprise me to find returns a little lower in 2020.

Portfolio analysis

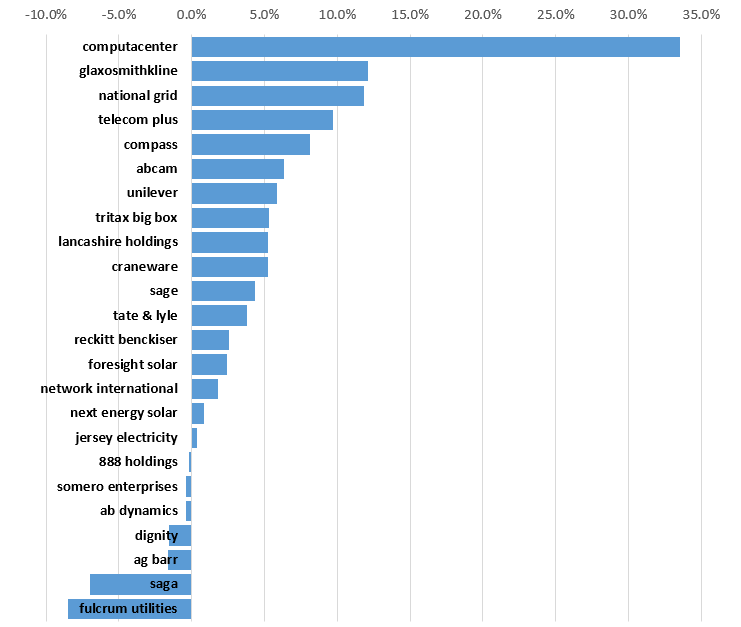

The best performer in the portfolio was Computacenter, with a 78% increase, 6 other holdings increased by 20%+. Overall 17 out of 24 holdings finished the year in positive territory. Some of the portfolio were only purchased over the last few months, so I'm not expecting to see much movement from those.

Summary of 2019 portfolio performance

Portfolio analysis

The best performer in the portfolio was Computacenter, with a 78% increase, 6 other holdings increased by 20%+. Overall 17 out of 24 holdings finished the year in positive territory. Some of the portfolio were only purchased over the last few months, so I'm not expecting to see much movement from those.

Summary of 2019 portfolio performance

|

| Portfolio holdings and 2019 performance |

The large international stocks lost a little ground when Sterling started to climb out of the doldrums and have mostly traded sideways since. I’m comfortable holding these for the long term and am unconcerned by a little volatility. If prices continue to drop then I will be looking to top up.

I don’t imagine Computacenter will put in the same performance next year, but it is a well run and growing business, and I have no qualms continuing to hold.

The poor performers were Fulcrum Utilities, Saga and Dignity which have a more detailed write up below.

The contribution of each holding to the final position at year end was as follows:

Once again the outlier is Computacenter, but there are another 9 companies contributing between 5% and 10%. The under performing holdings don't have such a significant impact as the investment is smaller. My risk averse strategy of keeping riskier holdings smaller until they prove themselves I believe to be correct and has

helped contain the impact of the poor performers. I would be comfortable increasing investment into those smaller holdings that are providing a positive contribution.

The contribution of each holding since the start of the portfolio in 2018 is below. It also shows the split of capital vs. dividend for each holding:

During the year I added in cost of capital calculations to the stock selection criteria, and an indicator of recent price movements vs. the share price 52 week high. I now have a list of businesses I’m comfortable investing in that I’m gradually

growing. I have been aggressively rejecting watchlist candidates that don’t

come up to scratch, and only intend to buy from this list. And only when the

price looks attractive. The increased analysis, and change in approach I’ve

adopted resulted in 1 of the 13 investments this year significantly under-performing.

This could have been avoided had I waited until the dropping price showed signs

of stabilising.

Buying and selling

The contribution of each holding to the final position at year end was as follows:

|

| Contributions of holdings to portfolio performance in 2019 |

The contribution of each holding since the start of the portfolio in 2018 is below. It also shows the split of capital vs. dividend for each holding:

|

| Historical contributions showing split of capital and dividends |

Over time the dividend contribution should

increase even if capital moves around. I intend to increase the dividend yield during 2020, but not at the expense of quality. Finding quality investments that offer a higher yield than the 2019 2.5% yield should be possible and several on the watchlist meet this criteria.

Poor

performers and lessons learnt.

The

worst performer was Fulcrum Utilities. Whilst I looked at the financials and

the business prior to purchasing, what was missed was the share price movement.

Price was slowly declining when I purchased, and that continued during the following

few months until it bottomed around it’s current price. It has since moved

sideways for a number of months. It has potential in my view and I’m optimistic

about a couple of strands of it’s business: smart meters and electric vehicle charging

points. I intend to continue to hold but will be keeping a close eye on this

one.

The

two other notable laggards are Saga and Dignity. Both of these were purchased a

while ago and followed the same pattern. Both were companies that had a drop in share price following bad news, and were purchased as a contrarian recovery play. The

inadequate thought put into the transactions has been rewarded with a

significant reduction in value. The only saving grace is that I had the good

sense to keep the investment small. The share price of both companies has staged

a decent increase over the year and I will keep both for as long as that price

momentum holds.

Saga

is, in my view, un-investable. It is not a business but a collection of

activities, based around the notion that after a certain birthday people need/

want to be treated differently. This is nonsense. Watching my 70+ parents and in-laws

fit and well and using the latest technology, illustrates the flawed concept on

which Saga is built. There is now a stake in the company by Elliott Advisors, an

aggressive Hedge Fund activist investor from the US. Their involvement would

indicate that they see value in the company that is greater than the current

share price. They have made noises to break up the company into separate travel

and insurance business, which could then be either sold off or streamlined.

There may be further recovery here, but we will part company if it stalls.

Dignity

is a great sounding investment idea. Relying on people dying is about as

certain an income stream as I could imagine. However the business has not been

effectively managed. An acquisition spree was funded by borrowing, and that

strategy was taking too long to generate returns, at the expense of a

deteriorating balance sheet. In addition there has been significant regulatory

scrutiny. Cancelling the dividend and a period of introspection are both the

correct paths forward for better long-term prospects. Having worked in

businesses needing a significant turnaround I am aware of the extent of the

internal disruption that it can cause to a business. For this reason, and the

extent of the borrowing, Dignity is also to be sold when the momentum behind

it’s price recovery slows.

Buying and selling

- Tritax

Big Box (January)

- Manx

Telecom (January)

- Fulcrum

Utilities (March)

- Abcam

(April)

- Reckitt

Benckiser (April)

- Somero

Enterprises (June)

- Craneware

(July)

- AG

Barr (July)

- Network

International (August)

- Telecom

Plus (September)

- Foresight

Solar (October)

- Next

Energy Solar (November)

- AB

Dynamics (December)

These

were all new additions to the portfolio, I haven't topped up any existing

holdings.

Manx

Telecom was acquired shortly after I invested, leaving the portfolio for a 32%

profit. I have not sold any other shares.

Conclusion

I’m

pleased with investments this year, with a good performance from the portfolio.

It has balanced the performance from last year so that across the two years I have

a solid return.

Who knows what the coming year will bring. Macro-economic

conditions continue to look wobbly, Brexit could once again take centre

stage later in the year with concerns over trade with the EU, and US elections in

the Autumn will probably cause a stir.

Looking forward to more investment fun in 2020.

No comments:

Post a Comment