The All Weather Portfolio was the brainchild of Ray Dalio and his pals at Bridgewater which was eventually put to use in the 1990's. The history behind their thinking can be found here. As the name suggests the idea behind the portfolio construction was to build a fund that could generate returns in any economic environment. And looking at some basic stats it has done just that, and has a CAGR of around 7% since 2007.

The foundation of the portfolio was the notion that there are a limited number of factors driving returns in various asset classes. This was boiled down to 4 economic environments, a growing or shrinking economy, and rising or falling inflation as shown below:

And the idea that various asset classes outperformed in those different growth and/ or inflation environments:

However it wasn't simply a judgement of where to find the best returns, the All Weather portfolio was a risk parity portfolio. To this end the construction of the portfolio was designed such that each asset class was limited to the same amount of risk. Using the 4 environments above the portfolio was built such that there was an equal risk distributed across the different environments and the returns that each asset class would provide.

Risk, as I discussed in a previous post is a slippery notion in investing. But within the context of the All Weather portfolio, risk is viewed as volatility, and the portfolio is designed to reduce this whilst maintaining a steady return.

The exact contents of the Bridgewater portfolio is understandably kept under wraps. However, in an interview with self-help guru Tony Robbins, Dalio revealed the outline of the fund. It is roughly:

- 40% long-term bonds

- 30% stocks

- 15% intermediate-term bonds

- 7.5% gold

- 7.5% commodities

So armed with this information, using readily available investments one could recreate an approximation of the Bridgewater All Weather portfolio. And using the excellent portfoliovizualiser site, as noted above, we can see that using the above allocations, the portfolio seems to have performed pretty well, generating a reasonable 7% CAGR with a relatively low degree of volatility.

I decided to play around in googlesheets to try out a version of the portfolio with a few funds that seemed to cover off the main asset classes:

- 40% long-term bonds: SPDR Barclays 15+ Year Gilt UCITS ETF (GLTL)

- 30% stocks: S&P 500 UCITS ETF (VUSA)

- 15% intermediate-term bonds: Lyxor iBoxx $ Treasuries 1-3yr UCITS ETF (U13G)

- 7.5% gold: WisdomTree Physical Gold (PHGP)

- 7.5% commodities: Lyxor Commodities Thomson Reuters/CoreCommodity CRB (CRBU)

Feel free to download a copy of the spreadsheet and play around with the funds. I've not spent a lot of time trying to pick the best or cheapest funds so there may well be better alternatives out there.

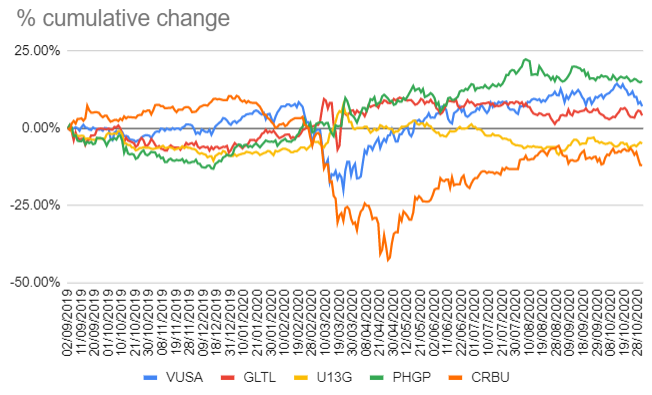

One of the attractions of the portfolio is that it removes the need for market timing, whenever you start should make no difference. So I took data from around a year ago, as this would include the bull run in equities at the end of 2019, and the impact of the pandemic during 2020 (September 2019 - October 2020). During this period we can see that the different investment funds had a relatively limited range of diversion up until the pandemic hit the headlines, at which point, their reactions diverged considerably.

The overall performance of the portfolio assuming the above construction is below:

It held up pretty well, doing what it was designed to do I guess.

This type of investment does interest me, the last month at work has been crazy busy, (with this post stuck in draft for the past couple of weeks😴) and the idea of having a basket of investments that doesn't need much TLC other than an occasional rebalance certainly appeals. I enjoy the analysis and investigation of individual companies, and so far my own investments are doing ok. But should life get in the way of the investing process, I'd be quite happy to switch over to this sort of investing instead.

No comments:

Post a Comment