The UK markets were drifting sideways during the start of January, and US markets predictably continuing their upwards march. Then everything went a bit George Romero with the appearance of Coronavirus. Shares started getting sold off in what appeared to be a rather indiscriminate way, but with Asia exposed equities bearing the brunt.

If the news media are to be believed, we have an impending apocalypse, so share prices are the least of our worries. Perhaps a more likely scenario is a short-term health scare that is resolved over the next few months. If a few bargains present themselves I might as well indulge, after all if we return to normal, I'll have bought some shares at a discount. If the end is nigh, it won't matter anyway, checking my portfolio is likely to drift down the to-do list in favour of barricading the windows and hunkering down over my last tin of beans.

Portfolio performance

The portfolio was down -0.6% in January, losing less than my chosen benchmark the Vanguard FTSE All Share Accumulation which was down -2.8% over the same period.

Best performers this month:

National Grid +7%

Fulcrum Utilities +7%

AB Dynamics +5%

Worst performers this month:

Craneware -26%

SAGA -21%

888 Holdings -18%

January share purchase: NICL

AIM listed soft drinks company Nichols (NICL) joined the portfolio this month. Nichols have a portfolio of products, the most iconic of which is Vimto. They have sat on the watchlist for a while, and my interest began to perk up when the share price started drifting downwards after bumping against a previous high point. Then just before Christmas the company released an update stating that in one of their markets, the Middle East, Saudi Arabia and UAE were applying a 50% tax to soft drinks. The share price predictably tanked by around 20%. Given that this region generated just under 7% of revenues in 2018/19, it seemed a typical market over-reaction.

Nichols have some great operating numbers: ROCE over 20% in each of the last 10 years, along with double digit net margins, no debt, plus a dividend well covered by free cash flow that has increased by an annualised 13% over the same time. They have been able to generate these sorts of returns by outsourcing the production of their main brand - Vimto - and by doing so greatly reduce the capital requirements of the business. Vimto is also licensed for production in other confectionery products, again with minimal capital.

Revenues and profits have been ticking upwards over recent years, while the share price has remained fairly flat, possibly due to it getting an excessive premium which it needed to justify. The Middle East taxation issue shouldn't put too large a dent in either top or bottom line, even with a bit of additional marketing in the region.

The business was founded in 1908 and was listed on the AIM market in 2004. John Nichols, the grandson of the founder of the company remains on the board as Chairman, and owns 2m shares which amounts to a 5.5% stake in the company, worth around £27m as at the time of writing. Other members of the family also own shares and are employed by Nichols, so they have an interest in ensuring the ongoing success of the business.

Saturday 1 February 2020

Thursday 16 January 2020

2020 Goals & strategy review and update

Taking a look back at previous performance with a critical eye is a good discipline, I find it helps to reset. It's useful to find those areas of success and failure, to pat oneself on the back and dust off any hubris at the same time. But it is inherently backwards looking, so with the 2019 review out of the way it's time to look ahead and to think about goals, my strategy for achieving them, and how to track progress against them.

Long term goals

My investment goals posted at the start of last year were modest, but realistic:

Don't lose money.

Hopefully self explanatory...

Goals for 2020

Long term goals

My investment goals posted at the start of last year were modest, but realistic:

- Don’t lose money

- Increase capital by more than the rate of inflation

- Build a conservative dividend paying portfolio

And I would also wanted to beat the UK stock market, as measured through the FTSE All Share. The reason for this final ambition was simply one of risk vs. reward. If I was unable to beat an index fund by picking individual stocks, then I should buy the index fund as this would provide better reward for (arguably) less risk (see my post on index funds for more thoughts on this).

The above long term goals are fine I believe, and do not need to change. However, I think they do need more detail which is below:

Don't lose money.

Hopefully self explanatory...

Increase capital by more than the rate of inflation.

The price of the shares that I own is going to fluctuate, but over the long term, if I have invested in quality businesses they should increase in value. So long as they increase in value faster than inflation, should I decide to sell them, I will end up with more money than I started with - in real terms. Perhaps an unambitious goal, but very much linked to the first one above.

Build a conservative dividend paying portfolio.

This is the key goal for me, as I want to use this investment to generate income in the future. I want the portfolio to have a relatively low level of volatility, and to be consistently paying dividends, and for those dividends to be growing. The dividend growth will be partly organic - through the businesses in which I'm invested growing their dividends, and I will continue to increase the amount invested to also increase the dividend return.

Not every investment will be dividend focused. If I notice an interesting business, that is attractively priced, I may invest - but these will generally form the smaller, non-core elements of the portfolio.

The price of the shares that I own is going to fluctuate, but over the long term, if I have invested in quality businesses they should increase in value. So long as they increase in value faster than inflation, should I decide to sell them, I will end up with more money than I started with - in real terms. Perhaps an unambitious goal, but very much linked to the first one above.

Build a conservative dividend paying portfolio.

This is the key goal for me, as I want to use this investment to generate income in the future. I want the portfolio to have a relatively low level of volatility, and to be consistently paying dividends, and for those dividends to be growing. The dividend growth will be partly organic - through the businesses in which I'm invested growing their dividends, and I will continue to increase the amount invested to also increase the dividend return.

Not every investment will be dividend focused. If I notice an interesting business, that is attractively priced, I may invest - but these will generally form the smaller, non-core elements of the portfolio.

Goals for 2020

The shorter term goals for 2020 are unexciting, which is essentially to do more of the same. Investing in quality, low risk businesses that pay dividends.

My strategy for the upcoming year is to continue to build a low risk portfolio of dividend paying stocks. As at the start of January 2020 I am invested in 24 businesses but only around 12 of those I consider to be core holdings. I would rather continue to diversify before building the existing core holdings. Some of the small positions I have I will add to if the prices are appropriate, others I will keep as smaller holdings as I think they have greater risk. I would like to get to around 30 core investments with roughly equal amounts invested into each. I will continue to search out lower risk businesses that look to have certain indications of quality - high returns on capital, good margins, good cashflow, and preferably low debts. The portfolio will continue to maintain larger holdings in relatively low risk investments, with a few small racier positions to complement them.

Selling activity is likely to be limited, but if the business no longer meets my investment criteria it will leave the portfolio. As a result the portfolio churn will hopefully be minimal.

Valuations

I have also considered what value my portfolio might be and what dividends it should pay at the point that I decide to retire. Perhaps surprisingly the value is of lesser concern, I have plotted a path on the chart below which indicates an annual growth rate of 8% which is just over the total return of the FTSE All Share for the past 10 years. This doesn't seem to be an unrealistic target but time will tell if I'm able to keep up.

Of greater concern are the following:

- rate of investment

- dividend payments

If I want the portfolio to generate income, then I need to pay attention to dividends. They need to be sustainable over the long term, the businesses in which I invest should have demonstrated that they can manage their capital sensibly and are not forced to cut dividend payments, and they should return a dividend that increases over time.

This is deeply connected to my ability to increase the amount invested in my portfolio. I can't control the prices and movements in the underlying value of the portfolio. Nor can I control the capital allocation decisions made by the management of the companies in which I'm invested - so I don't control the dividends either. However, I can choose to invest each month, and will track my progress of this against a realistic target. Although I can't control them, I can model dividend income based on a few assumptions, such as suggested here. Assuming I continue to invest I can model the potential increases in dividend payment as the following:

- If the dividends paid on my investments increase by 2.5% each year then my retirement portfolio will receive in dividends the same amount I intend to invest each year. In other words at the point of retirement the portfolio would still grow at the same rate but without any additional funding from me, it would happen entirely through dividends.

- If the dividends increased by 10% each year, then my retirement portfolio would pay out annually 2.5x the amount I am investing.

So in the 2.5% increase scenario, if I invested £10k per year, at retirement in 20 years, my portfolio would pay out £10k in dividends each year.

In the 10% increase scenario, if I invested £10k per year, at retirement in 20 years, my portfolio would pay out £25k in dividends each year.

Sunday 5 January 2020

Annual review 2019

With

2019 behind us and a new year to look forward to it’s time to appraise my

investment decisions and performance for 2019.

My specific benchmark is the Vanguard FTSE All Share (Accumulation) tracker.

Investment

goals:

- Don’t lose money

- Increase capital by more than the rate of inflation

- Build a conservative dividend paying portfolio

My specific benchmark is the Vanguard FTSE All Share (Accumulation) tracker.

Portfolio

performance

During

2019 the portfolio has

increased in value by 23.6%. This

compares to an increase of 19% in my benchmark.

Total return

FTSE All Share Tracker

|

Portfolio

|

|

2018

|

-9.6%

|

1.6%

|

2019

|

19%

|

23.6%

|

Compound

Annual Growth Rate

FTSE All Share Tracker

|

Portfolio

|

|

2018

|

-9.6%

|

1.6%

|

2019

|

3.7%

|

12.1%

|

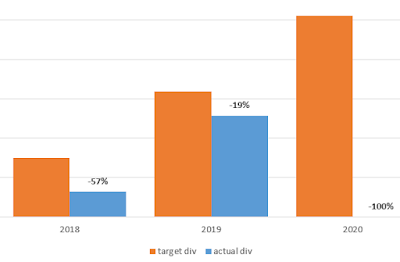

Dividend

yield

At

the end of the year the dividend yields of both benchmark and portfolio were

the following:

All Share Tracker yield: 4.08%

Portfolio 2019 trailing yield: 2.5%

Portfolio total yield from January 2018: 3.1%

Of the portfolio growth, 85% was from capital, 15% from dividends.

Portfolio 2019 trailing yield: 2.5%

Portfolio total yield from January 2018: 3.1%

Of the portfolio growth, 85% was from capital, 15% from dividends.

In summary, I'm pleased at the portfolio performance over the year, but most markets across the globe were on an upwards trend after a significant sell off during Q4 2018. I think a good chunk of positive sentiment was a recovery from that sell off. In the UK specifically we had Brexit to contend with, and the election of the Conservatives with a large majority helped to clarify the path forward for this a little. Since we won't have the same positives buoying the markets in 2020, and we have heightened expectations after a good run in 2019 it wouldn't surprise me to find returns a little lower in 2020.

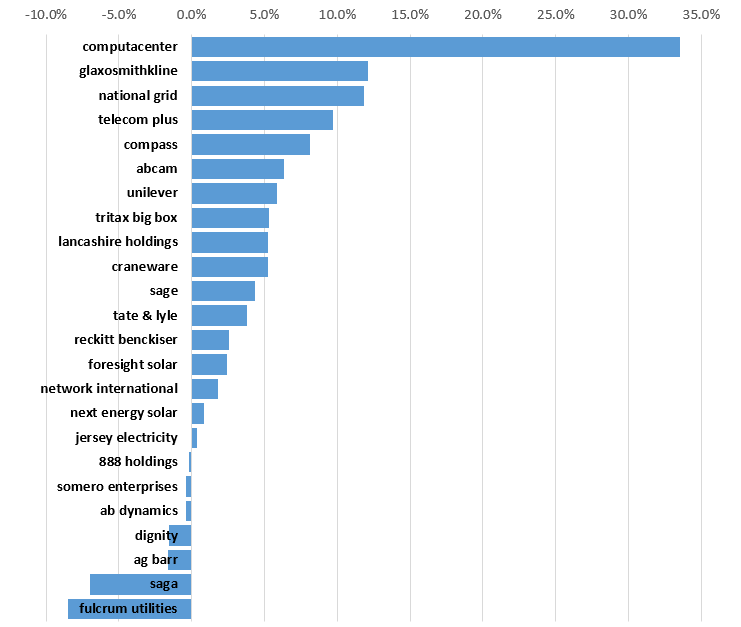

Portfolio analysis

The best performer in the portfolio was Computacenter, with a 78% increase, 6 other holdings increased by 20%+. Overall 17 out of 24 holdings finished the year in positive territory. Some of the portfolio were only purchased over the last few months, so I'm not expecting to see much movement from those.

Summary of 2019 portfolio performance

Portfolio analysis

The best performer in the portfolio was Computacenter, with a 78% increase, 6 other holdings increased by 20%+. Overall 17 out of 24 holdings finished the year in positive territory. Some of the portfolio were only purchased over the last few months, so I'm not expecting to see much movement from those.

Summary of 2019 portfolio performance

|

| Portfolio holdings and 2019 performance |

The large international stocks lost a little ground when Sterling started to climb out of the doldrums and have mostly traded sideways since. I’m comfortable holding these for the long term and am unconcerned by a little volatility. If prices continue to drop then I will be looking to top up.

I don’t imagine Computacenter will put in the same performance next year, but it is a well run and growing business, and I have no qualms continuing to hold.

The poor performers were Fulcrum Utilities, Saga and Dignity which have a more detailed write up below.

The contribution of each holding to the final position at year end was as follows:

Once again the outlier is Computacenter, but there are another 9 companies contributing between 5% and 10%. The under performing holdings don't have such a significant impact as the investment is smaller. My risk averse strategy of keeping riskier holdings smaller until they prove themselves I believe to be correct and has

helped contain the impact of the poor performers. I would be comfortable increasing investment into those smaller holdings that are providing a positive contribution.

The contribution of each holding since the start of the portfolio in 2018 is below. It also shows the split of capital vs. dividend for each holding:

During the year I added in cost of capital calculations to the stock selection criteria, and an indicator of recent price movements vs. the share price 52 week high. I now have a list of businesses I’m comfortable investing in that I’m gradually

growing. I have been aggressively rejecting watchlist candidates that don’t

come up to scratch, and only intend to buy from this list. And only when the

price looks attractive. The increased analysis, and change in approach I’ve

adopted resulted in 1 of the 13 investments this year significantly under-performing.

This could have been avoided had I waited until the dropping price showed signs

of stabilising.

Buying and selling

The contribution of each holding to the final position at year end was as follows:

|

| Contributions of holdings to portfolio performance in 2019 |

The contribution of each holding since the start of the portfolio in 2018 is below. It also shows the split of capital vs. dividend for each holding:

|

| Historical contributions showing split of capital and dividends |

Over time the dividend contribution should

increase even if capital moves around. I intend to increase the dividend yield during 2020, but not at the expense of quality. Finding quality investments that offer a higher yield than the 2019 2.5% yield should be possible and several on the watchlist meet this criteria.

Poor

performers and lessons learnt.

The

worst performer was Fulcrum Utilities. Whilst I looked at the financials and

the business prior to purchasing, what was missed was the share price movement.

Price was slowly declining when I purchased, and that continued during the following

few months until it bottomed around it’s current price. It has since moved

sideways for a number of months. It has potential in my view and I’m optimistic

about a couple of strands of it’s business: smart meters and electric vehicle charging

points. I intend to continue to hold but will be keeping a close eye on this

one.

The

two other notable laggards are Saga and Dignity. Both of these were purchased a

while ago and followed the same pattern. Both were companies that had a drop in share price following bad news, and were purchased as a contrarian recovery play. The

inadequate thought put into the transactions has been rewarded with a

significant reduction in value. The only saving grace is that I had the good

sense to keep the investment small. The share price of both companies has staged

a decent increase over the year and I will keep both for as long as that price

momentum holds.

Saga

is, in my view, un-investable. It is not a business but a collection of

activities, based around the notion that after a certain birthday people need/

want to be treated differently. This is nonsense. Watching my 70+ parents and in-laws

fit and well and using the latest technology, illustrates the flawed concept on

which Saga is built. There is now a stake in the company by Elliott Advisors, an

aggressive Hedge Fund activist investor from the US. Their involvement would

indicate that they see value in the company that is greater than the current

share price. They have made noises to break up the company into separate travel

and insurance business, which could then be either sold off or streamlined.

There may be further recovery here, but we will part company if it stalls.

Dignity

is a great sounding investment idea. Relying on people dying is about as

certain an income stream as I could imagine. However the business has not been

effectively managed. An acquisition spree was funded by borrowing, and that

strategy was taking too long to generate returns, at the expense of a

deteriorating balance sheet. In addition there has been significant regulatory

scrutiny. Cancelling the dividend and a period of introspection are both the

correct paths forward for better long-term prospects. Having worked in

businesses needing a significant turnaround I am aware of the extent of the

internal disruption that it can cause to a business. For this reason, and the

extent of the borrowing, Dignity is also to be sold when the momentum behind

it’s price recovery slows.

Buying and selling

- Tritax

Big Box (January)

- Manx

Telecom (January)

- Fulcrum

Utilities (March)

- Abcam

(April)

- Reckitt

Benckiser (April)

- Somero

Enterprises (June)

- Craneware

(July)

- AG

Barr (July)

- Network

International (August)

- Telecom

Plus (September)

- Foresight

Solar (October)

- Next

Energy Solar (November)

- AB

Dynamics (December)

These

were all new additions to the portfolio, I haven't topped up any existing

holdings.

Manx

Telecom was acquired shortly after I invested, leaving the portfolio for a 32%

profit. I have not sold any other shares.

Conclusion

I’m

pleased with investments this year, with a good performance from the portfolio.

It has balanced the performance from last year so that across the two years I have

a solid return.

Who knows what the coming year will bring. Macro-economic

conditions continue to look wobbly, Brexit could once again take centre

stage later in the year with concerns over trade with the EU, and US elections in

the Autumn will probably cause a stir.

Looking forward to more investment fun in 2020.

Wednesday 1 January 2020

December 2019 portfolio update

So that's 2019 finished. The highlight of the month saw Tweedledum taking the honours in the Westminster egg and spoon race. Tweedledee was left scratching his beard, blaming everything except the bonkers set of policies in his little red book. At least that's one lot of nonsense out of the way, and should provide some clarity on Brexit. Hopefully some day soon it will be safe to turn on the news on the telly again and not want to throw things at it.

The Sterling rally I was hoping for duly appeared as soon as the election exit poll was released. And then disappeared when someone forgot to keep Boris in his kennel, letting him create another Brexit cliff edge for us. So the FTSE100 xmas sale I wanted didn't materialise. I suspect the China deal with the US won't hold together, and a crazed Trumpy will want to go on a tariff rampage early in the new year, so I hold out hope for some January bargains.

So in expectation of a few market wobbles early in the new year, I'm staying patient and am continuing to research potential purchases.

Portfolio performance

The portfolio was up +3.6% in December, ahead of my chosen benchmark the Vanguard FTSE All Share Accumulation which was up +2.8% over the same period.

Best performers this month:

Somero +39%

Computacenter +17%

Telecom Plus +13%

Worst performers this month:

Fulcrum Utilities -15%

Jersey Electricity -6%

Unilever -5%

December share purchase: ABDP

AB Dynamics (ABDP) joined the portfolio this month. ABDP provide technology for car manufacturers to test their vehicles, including various aspects of vehicle dynamics, safety features, and automation. I looked at this company a long time ago but never bought any shares, the price took off and never glanced back. All the time I was like a nervous toddler at the bottom of an escalator - trying to work out if I should step on. A 30% pull back in the price over the past few months encouraged me to indulge, but they are still expensive, so I have kept the purchase small.

It might seem a bad time to get involved in the car industry given the slowdown in economies across the globe, especially since cars are expensive and likely to be hard hit if people are tightening their belts. However, ABDP get their money not from car sales but from manufacturer R&D spend. Clearly if car sales collapse - R&D will likely reduce too, but should be more resilient that simple revenues. Cars are undergoing a fair degree of change including the move away from fossil fuels, and automated vehicles looming on the horizon. It is these sorts of longer term trends that ABDP have benefited from, and hopefully will continue to do so.

The ABDP financials are extremely solid, with ROCE and net margins averaging 19% and 16% respectively since their listing on the LSE in 2013, and they have no debt. They are also managed in a manner that I like, demonstrated earlier in the year when they raised capital through a share placing in order to fund a couple of acquisitions, rather than borrow. I think the last thing a high growth company such as this needs is a load of debt to complicate life.

The founder of the company remains on the board and holds around 20% of the equity, with his wife owning a further 6.5%. Despite a bit of selling from the pair of them in the Autumn, as significant shareholders they should have the interest of investors front and centre of their thinking.

The main negative is the price - if business performance wobbles then I expect sellers to be out in force. There is also a tiny dividend, but I'll forgive that if growth continues at anything like the pace it has done over recent years.

The Sterling rally I was hoping for duly appeared as soon as the election exit poll was released. And then disappeared when someone forgot to keep Boris in his kennel, letting him create another Brexit cliff edge for us. So the FTSE100 xmas sale I wanted didn't materialise. I suspect the China deal with the US won't hold together, and a crazed Trumpy will want to go on a tariff rampage early in the new year, so I hold out hope for some January bargains.

So in expectation of a few market wobbles early in the new year, I'm staying patient and am continuing to research potential purchases.

Portfolio performance

The portfolio was up +3.6% in December, ahead of my chosen benchmark the Vanguard FTSE All Share Accumulation which was up +2.8% over the same period.

Best performers this month:

Somero +39%

Computacenter +17%

Telecom Plus +13%

Worst performers this month:

Fulcrum Utilities -15%

Jersey Electricity -6%

Unilever -5%

December share purchase: ABDP

AB Dynamics (ABDP) joined the portfolio this month. ABDP provide technology for car manufacturers to test their vehicles, including various aspects of vehicle dynamics, safety features, and automation. I looked at this company a long time ago but never bought any shares, the price took off and never glanced back. All the time I was like a nervous toddler at the bottom of an escalator - trying to work out if I should step on. A 30% pull back in the price over the past few months encouraged me to indulge, but they are still expensive, so I have kept the purchase small.

It might seem a bad time to get involved in the car industry given the slowdown in economies across the globe, especially since cars are expensive and likely to be hard hit if people are tightening their belts. However, ABDP get their money not from car sales but from manufacturer R&D spend. Clearly if car sales collapse - R&D will likely reduce too, but should be more resilient that simple revenues. Cars are undergoing a fair degree of change including the move away from fossil fuels, and automated vehicles looming on the horizon. It is these sorts of longer term trends that ABDP have benefited from, and hopefully will continue to do so.

The ABDP financials are extremely solid, with ROCE and net margins averaging 19% and 16% respectively since their listing on the LSE in 2013, and they have no debt. They are also managed in a manner that I like, demonstrated earlier in the year when they raised capital through a share placing in order to fund a couple of acquisitions, rather than borrow. I think the last thing a high growth company such as this needs is a load of debt to complicate life.

The founder of the company remains on the board and holds around 20% of the equity, with his wife owning a further 6.5%. Despite a bit of selling from the pair of them in the Autumn, as significant shareholders they should have the interest of investors front and centre of their thinking.

The main negative is the price - if business performance wobbles then I expect sellers to be out in force. There is also a tiny dividend, but I'll forgive that if growth continues at anything like the pace it has done over recent years.

Thursday 19 December 2019

Currency movements and share price correlations

A nice post on the Freetrade community forum prodded me into a dig around into the relationship between the value of Sterling/GBP and a companies' share price.

The reasons for currency movements were nicely summarised in the post above.

The majority of businesses listed on the LSE are traded in Sterling. Any valuation of a business in non-sterling terms, will need to be converted back into Sterling if the shares are being traded in GBP. Assets and liabilities - the stock, cash, leases etc. belonging to the business has to be revised into Sterling if we are going to understand the value of the company, which is in then reflected in the share price.

Using the Dollar to Sterling comparison, lets look at what happens when the exchange rate varies. Assume that a company makes $1000 and that this has to be converted into GBP.

If $1 = £1 then $1000 = £1000

If $2 = £1 then $1000 = £500

If $0.5 = £1 then $1000 = £2000

In the above scenarios, if the two currencies are equal, then $1000 taken in the US ends up as £1000 when converted to GBP. If Sterling increases in value relative to the Dollar, as in the 2nd scenario, so that £1 now buys $2, the same $1000 taken in the US only produces £500. The opposite happens in the 3rd scenario, where Sterling decreases in value relative to the Dollar and now £1 only buys $0.5 - in this case our $1000 converts into £2000.

Investing in companies listed in the UK does not shield those investments from currency movements. According to research by FTSE Russell in 2017 (they don't appear to have a 2019 version) the FTSE 100 generated 71% of revenues globally rather than domestically (within the UK).

However, there are plenty of businesses whose earnings are UK based. So in theory we should see that if Sterling gets stronger, the overseas earners will see the value of the overseas earnings reduce and their share price fall accordingly. And we might expect to see the opposite for those companies that earn their money in the UK - an increase in the value of Sterling relative to the currency in which earnings are made should see their share price increase, if for no other reason than that it is a reflection of the strength of the UK economy. Lets find a few companies with a high % of overseas earnings and some equivalents making their money in Blighty.

First we need to find some companies with high % of non-UK revenues:

Ferguson: 10% from the UK (2019 annual report)

Ashtead: 11% from the UK (2019 annual report)

Unilever: 7% from UK/ Netherlands (2018 annual report - UK not split out separately)

Diageo: 23% from Europe (2019 annual report - UK not split out separately)

Compass: 23% from Europe (2019 final results - UK not split out separately)

Note: I've put the source of the info in brackets - there may well be better sources out there.

And some businesses with high % of UK revenues:

Lloyds: 100% from the UK (2018 annual report states non-UK activity is too small to report)

Autotrader: 99% from the UK (2019 annual report)

Rightmove: 98% from the UK (2018 annual report)

Barrett: 100% from the the UK (2019 annual report)

Morrisons: 100% from the UK (2018 annual report)

As we can see, for some large global companies reporting specifically on UK revenues isn't considered material and is not even on the radar.

However lets run some stats and see what we find. I have a googlesheet pulling currency movements and share prices - specifically GBP vs. USD over the last 5 years, and the correlation between the two. Feel free to download a copy - the ticker, and dates can be changed as you like.

For those needing a stats refresher, the correlation score (correlation coefficient aka R) tells us a bit about how these two numbers (currency movements vs. share price movements) are moving in relation to each other. The output ranges between -1 and 1. If they move up and down together, this is called a positive correlation, and a score closer to 1 indicates a stronger connection. If their movements don't appear to be synchronised at all, the score will be closer to 0, indicating no pattern detected. If the numbers move in opposite directions, the score will be closer to -1 and is called a negative correlation.

In addition there is something known as R² (coefficient of determination), which is supposed to indicate how much of the correlation between share prices and currency movements is a result of currency moves rather than anything else that might move the share price. You'll see this as a score between 0 and 1, which can be interpreted as a percentage.

Correlations:

Companies with high % of non-UK revenues:

Companies with high % of UK revenues:

It would seem that the likes of Lloyds, Compass and Unilever will dance to the tune of currency movements, whilst the likes of Barrett have rather a deaf ear.

Whilst this is interesting, before thinking about using any such stats in one's investment decisions, it may be worth paying a visit to the spurious correlations website first 😀.

The reasons for currency movements were nicely summarised in the post above.

The majority of businesses listed on the LSE are traded in Sterling. Any valuation of a business in non-sterling terms, will need to be converted back into Sterling if the shares are being traded in GBP. Assets and liabilities - the stock, cash, leases etc. belonging to the business has to be revised into Sterling if we are going to understand the value of the company, which is in then reflected in the share price.

Using the Dollar to Sterling comparison, lets look at what happens when the exchange rate varies. Assume that a company makes $1000 and that this has to be converted into GBP.

If $1 = £1 then $1000 = £1000

If $2 = £1 then $1000 = £500

If $0.5 = £1 then $1000 = £2000

In the above scenarios, if the two currencies are equal, then $1000 taken in the US ends up as £1000 when converted to GBP. If Sterling increases in value relative to the Dollar, as in the 2nd scenario, so that £1 now buys $2, the same $1000 taken in the US only produces £500. The opposite happens in the 3rd scenario, where Sterling decreases in value relative to the Dollar and now £1 only buys $0.5 - in this case our $1000 converts into £2000.

Investing in companies listed in the UK does not shield those investments from currency movements. According to research by FTSE Russell in 2017 (they don't appear to have a 2019 version) the FTSE 100 generated 71% of revenues globally rather than domestically (within the UK).

However, there are plenty of businesses whose earnings are UK based. So in theory we should see that if Sterling gets stronger, the overseas earners will see the value of the overseas earnings reduce and their share price fall accordingly. And we might expect to see the opposite for those companies that earn their money in the UK - an increase in the value of Sterling relative to the currency in which earnings are made should see their share price increase, if for no other reason than that it is a reflection of the strength of the UK economy. Lets find a few companies with a high % of overseas earnings and some equivalents making their money in Blighty.

First we need to find some companies with high % of non-UK revenues:

Ferguson: 10% from the UK (2019 annual report)

Ashtead: 11% from the UK (2019 annual report)

Unilever: 7% from UK/ Netherlands (2018 annual report - UK not split out separately)

Diageo: 23% from Europe (2019 annual report - UK not split out separately)

Compass: 23% from Europe (2019 final results - UK not split out separately)

Note: I've put the source of the info in brackets - there may well be better sources out there.

And some businesses with high % of UK revenues:

Lloyds: 100% from the UK (2018 annual report states non-UK activity is too small to report)

Autotrader: 99% from the UK (2019 annual report)

Rightmove: 98% from the UK (2018 annual report)

Barrett: 100% from the the UK (2019 annual report)

Morrisons: 100% from the UK (2018 annual report)

As we can see, for some large global companies reporting specifically on UK revenues isn't considered material and is not even on the radar.

However lets run some stats and see what we find. I have a googlesheet pulling currency movements and share prices - specifically GBP vs. USD over the last 5 years, and the correlation between the two. Feel free to download a copy - the ticker, and dates can be changed as you like.

For those needing a stats refresher, the correlation score (correlation coefficient aka R) tells us a bit about how these two numbers (currency movements vs. share price movements) are moving in relation to each other. The output ranges between -1 and 1. If they move up and down together, this is called a positive correlation, and a score closer to 1 indicates a stronger connection. If their movements don't appear to be synchronised at all, the score will be closer to 0, indicating no pattern detected. If the numbers move in opposite directions, the score will be closer to -1 and is called a negative correlation.

In addition there is something known as R² (coefficient of determination), which is supposed to indicate how much of the correlation between share prices and currency movements is a result of currency moves rather than anything else that might move the share price. You'll see this as a score between 0 and 1, which can be interpreted as a percentage.

Correlations:

Companies with high % of non-UK revenues:

Correlation coefficient (R)

|

Coefficient of determination (R²)

|

|

Ferguson

|

||

Ashtead

|

||

Unilever

|

||

Diageo

|

||

Compass

|

Companies with high % of UK revenues:

Correlation coefficient (R)

|

Coefficient of determination (R²)

|

|

Lloyds

|

||

Autotrader

|

||

Rightmove

|

||

Barrett

|

||

Morrisons

|

It would seem that the likes of Lloyds, Compass and Unilever will dance to the tune of currency movements, whilst the likes of Barrett have rather a deaf ear.

Whilst this is interesting, before thinking about using any such stats in one's investment decisions, it may be worth paying a visit to the spurious correlations website first 😀.

Sunday 1 December 2019

November 2019 portfolio update

Markets were up last month, I was a bit surprised there wasn't more of a sideways drift as we await any trade deals being agreed between the US and China, and domestically we get to "enjoy" the run in to the December election. An election I think was well summarised by Ian Shepherdson, chief economist at Pantheon Macroeconomics on CNBC “It is a terrible choice. Two dreadful, inadequate, dissembling, incompetent politicians and one of them is definitely going to be prime minister.”

I remain hopeful that a post-election Sterling rally will lower the price of few of the FTSE100, and also make overseas investments more palatable. There are a few blue chips I would like to add to the portfolio, and would also like to top up some of my current holdings, but am comfortable remaining patient.

I decided to add another renewable energy Investment Trust this month. I've arbitrarily decided that a premium of less than 10% puts them into buying territory. It's not ideal, but I've been on the sidelines for a while and there is clearly a long term trend towards renewables. These should also add a little diversification to the portfolio as their performance is less correlated to other equities.

Portfolio performance

The portfolio was up +2.7% in November, slightly ahead of my chosen benchmark the Vanguard FTSE All Share Accumulation which was up +2.2% over the same period.

Best performers this month:

Abcam +15%

Telecom Plus +11%

Computacenter +10%

Worst performers this month:

888 Holdings -9%

Compass -8%

Fulcrum Utilities -3%

November share purchase: NESF

NextEnergy Solar Fund (NESF) was the latest addition to the portfolio and joins Foresight Solar into which I invested in October. As I posted here I've been keeping an eye on renewable energy investment trusts for a while, but the high premiums have discouraged me. NESF drifted a little lower during the end of the month so I decided to invest.

NESF have 89 solar installations, mostly in the UK, with 8 in Italy. They have just finished their first subsidy free installation, and are due to complete a second, much larger, subsidy free plant in the next 6 months. They are a little smaller than Foresight but also a member of the FTSE 250. They listed in 2014, and have generated around 10% total return since IPO. I suspect this will be a little lower in the next year or two if the returns move closer to historical averages, but NESF pays a dividend in excess of 5% which I'll be happy to take.

Given the nature of the business I would expect it to be relatively Brexit proof, and may even benefit from a Labour Government, depending on how they want to fund investment into renewables (won't be holding my breath though). Nice to also see that during the first half of the year, NESF produced enough electricity to power 134,000 homes.

I remain hopeful that a post-election Sterling rally will lower the price of few of the FTSE100, and also make overseas investments more palatable. There are a few blue chips I would like to add to the portfolio, and would also like to top up some of my current holdings, but am comfortable remaining patient.

I decided to add another renewable energy Investment Trust this month. I've arbitrarily decided that a premium of less than 10% puts them into buying territory. It's not ideal, but I've been on the sidelines for a while and there is clearly a long term trend towards renewables. These should also add a little diversification to the portfolio as their performance is less correlated to other equities.

Portfolio performance

The portfolio was up +2.7% in November, slightly ahead of my chosen benchmark the Vanguard FTSE All Share Accumulation which was up +2.2% over the same period.

Best performers this month:

Abcam +15%

Telecom Plus +11%

Computacenter +10%

Worst performers this month:

888 Holdings -9%

Compass -8%

Fulcrum Utilities -3%

November share purchase: NESF

NextEnergy Solar Fund (NESF) was the latest addition to the portfolio and joins Foresight Solar into which I invested in October. As I posted here I've been keeping an eye on renewable energy investment trusts for a while, but the high premiums have discouraged me. NESF drifted a little lower during the end of the month so I decided to invest.

NESF have 89 solar installations, mostly in the UK, with 8 in Italy. They have just finished their first subsidy free installation, and are due to complete a second, much larger, subsidy free plant in the next 6 months. They are a little smaller than Foresight but also a member of the FTSE 250. They listed in 2014, and have generated around 10% total return since IPO. I suspect this will be a little lower in the next year or two if the returns move closer to historical averages, but NESF pays a dividend in excess of 5% which I'll be happy to take.

Given the nature of the business I would expect it to be relatively Brexit proof, and may even benefit from a Labour Government, depending on how they want to fund investment into renewables (won't be holding my breath though). Nice to also see that during the first half of the year, NESF produced enough electricity to power 134,000 homes.

Friday 22 November 2019

Dividends in 20 years

I found a couple of pieces published recently interesting - both related to dividends. It also gave me a bit of a nudge to dig into something I'd been meaning to look at for a while, modelling the sort of income I might expect from dividends in 20 years.

But first to the publications:

The Janus Henderson Global Dividend Index was published earlier this week which had a few interesting snippets. Dividends grew at a slower rate recently, caused by a slowing global economy, lower earnings, and therefore a slower rate of dividend growth. Also notable that once special dividends are stripped out of UK payments, they view the UK dividend growth as lagging global averages. I guess this may partly be due to the composition of the FTSE 100, which has a significant proportion of large banks, oil, and mining businesses (as I noted here), which are unlikely to find it easy to consistently grow their profits and therefore may struggle to consistently increase their dividends.

Morningstar published their latest thoughts on their Top 20 FTSE Dividend Paying Stocks. I like this treatment by Morningstar as it is more considered than most "Top dividend payers" lists, however it could look very different if risks were factored in, with tobacco companies transitioning away from cigarettes, fossil fuel businesses needing to transition to renewable energy, and industrials potentially at the eye of a storm if the global economy continues to slow. And of course the chaos that might ensue should Corbyn get the keys to No. 10 Downing Street.

So to the spreadsheets...

Income Modelling

In 20 years what income will I receive from dividends? As with any modelling it is a simplified version of reality, so I'll need to make some assumptions:

FTSE 100 and All Share index funds offer over 4% dividend yield, the S&P 500 is around 1.5%, my personal portfolio is approaching 3% so I've gone with a starting yield of 3%.

The Janus Henderson dividend growth rate globally for Q3 2019 was 2.8%, but longer term they reckon over 5% is more likely. Lets assume a slightly conservative 5% dividend growth.

I'm ignoring inflation, and insisting on a rather static model that has dividends set at 3% for the first year of investment in each year, and static increases of 5% per year. A more realistic model would be a bit more complicated, but not impossible - I think this is enough to be getting on with 😊.

And of course all the cash received as dividends will be reinvested. As I'm interested in modelling the income, I'm not considering the capital.

Since the dividend yield will grow at 5% per year, the yield will be (rounded to 2 decimal places):

year 1 = 3%

year 2 = 3.15%

year 3 = 3.31%

year 4 = 3.47%

.

.

.

year 20 = 7.58%

In it's first year, any investment will have a 3% yield, but by year 20 the yield will be 7.58%, so a £10k investment in year 1 will generate £300, the same £10k in year 20 will generate £758.

My investment in year 2 will only have 19 years to grow it's dividends, and starts with the same 3% in it's first year. However, it is boosted by the £300 from year 1. So the total new capital invested in year 2 is £10300 (£10k + £300 dividends). At a 3% yield, this returns £309, and in year 2 my £10k invested in year 1 now generates a 3.15% yield, £315. So year 2 total dividends are £624.

In year 3 I invest another £10k, plus the £624 above, and at a 3% yield, I get £318.72 in dividends. I also get £324.45 from the £10300 invested in year 2, and £330.75 from the £10k invested in year 1. Therefore year 3 total dividends are £973.92

By year 4, we can start to see the magic of compounding in action. The total dividend return assuming I had reinvested all prior dividends would be £1351.83, if dividends were not reinvested this would be £1200, more than 12% difference in just 4 years.

So in answer to my original question, what income will I receive? Using the above assumptions, it would be £13055.57, which on an investment of £200k is a yield of 6.53%.

There is a google sheet here where the assumptions of starting yield, growth rate and annual capital are shown, feel free to download a copy if it is of any interest.

But first to the publications:

The Janus Henderson Global Dividend Index was published earlier this week which had a few interesting snippets. Dividends grew at a slower rate recently, caused by a slowing global economy, lower earnings, and therefore a slower rate of dividend growth. Also notable that once special dividends are stripped out of UK payments, they view the UK dividend growth as lagging global averages. I guess this may partly be due to the composition of the FTSE 100, which has a significant proportion of large banks, oil, and mining businesses (as I noted here), which are unlikely to find it easy to consistently grow their profits and therefore may struggle to consistently increase their dividends.

Morningstar published their latest thoughts on their Top 20 FTSE Dividend Paying Stocks. I like this treatment by Morningstar as it is more considered than most "Top dividend payers" lists, however it could look very different if risks were factored in, with tobacco companies transitioning away from cigarettes, fossil fuel businesses needing to transition to renewable energy, and industrials potentially at the eye of a storm if the global economy continues to slow. And of course the chaos that might ensue should Corbyn get the keys to No. 10 Downing Street.

So to the spreadsheets...

Income Modelling

In 20 years what income will I receive from dividends? As with any modelling it is a simplified version of reality, so I'll need to make some assumptions:

- Timeframe = 20 years

- Amount invested each year = £10k

- Starting dividend yield = 3%

- Annual dividend growth = 5%

FTSE 100 and All Share index funds offer over 4% dividend yield, the S&P 500 is around 1.5%, my personal portfolio is approaching 3% so I've gone with a starting yield of 3%.

The Janus Henderson dividend growth rate globally for Q3 2019 was 2.8%, but longer term they reckon over 5% is more likely. Lets assume a slightly conservative 5% dividend growth.

I'm ignoring inflation, and insisting on a rather static model that has dividends set at 3% for the first year of investment in each year, and static increases of 5% per year. A more realistic model would be a bit more complicated, but not impossible - I think this is enough to be getting on with 😊.

And of course all the cash received as dividends will be reinvested. As I'm interested in modelling the income, I'm not considering the capital.

Since the dividend yield will grow at 5% per year, the yield will be (rounded to 2 decimal places):

year 1 = 3%

year 2 = 3.15%

year 3 = 3.31%

year 4 = 3.47%

.

.

.

year 20 = 7.58%

In it's first year, any investment will have a 3% yield, but by year 20 the yield will be 7.58%, so a £10k investment in year 1 will generate £300, the same £10k in year 20 will generate £758.

My investment in year 2 will only have 19 years to grow it's dividends, and starts with the same 3% in it's first year. However, it is boosted by the £300 from year 1. So the total new capital invested in year 2 is £10300 (£10k + £300 dividends). At a 3% yield, this returns £309, and in year 2 my £10k invested in year 1 now generates a 3.15% yield, £315. So year 2 total dividends are £624.

In year 3 I invest another £10k, plus the £624 above, and at a 3% yield, I get £318.72 in dividends. I also get £324.45 from the £10300 invested in year 2, and £330.75 from the £10k invested in year 1. Therefore year 3 total dividends are £973.92

By year 4, we can start to see the magic of compounding in action. The total dividend return assuming I had reinvested all prior dividends would be £1351.83, if dividends were not reinvested this would be £1200, more than 12% difference in just 4 years.

So in answer to my original question, what income will I receive? Using the above assumptions, it would be £13055.57, which on an investment of £200k is a yield of 6.53%.

There is a google sheet here where the assumptions of starting yield, growth rate and annual capital are shown, feel free to download a copy if it is of any interest.

Friday 1 November 2019

October 2019 portfolio update

Another month of markets bouncing around in response to the ongoing brexit yawnfest. Sterling movements seem to be driving a lot of prices, I'm staying patient as although the big international blue chips have come down in price, I suspect they have another leg down if chances of a hard brexit recede. As sterling appreciates it will also start to bring into play a number of businesses listed outside the UK that I'm interested in, but we're not quite there yet.

Portfolio

The portfolio had a slight fall during October, but was ahead of the wider markets which were pulled down further by some big names posting disappointing updates. The portfolio was down -0.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was down -1.4% over the same period.

Top 3 holdings:

888 Holdings +17%

Dignity +9%

Fulcrum Utilities +7%

Bottom 3 holdings:

Craneware -6%

SAGA -7%

Tate & Lyle -9%

October share purchase: FSFL

Foresight Solar (FSFL) was added to the portfolio in October. As I posted here I've been keeping an eye on renewable energy investment trusts for a while, but have been reluctant to commit due to the premium on most of these. A share issue brought the premium on FSFL this down a little so I decided it was time to invest.

FSFL have 54 solar installations, 50 in the UK and 4 in Australia. They are the largest of the three solar energy investment trusts listed on the FTSE. They listed in 2013, and have generated around 8% total return since IPO, most of which is via dividends which are in excess of 5%.

UK solar subsidies dried up a couple of years ago, since when UK based installations have slowed, so solar funds have looked overseas for attractive investments. Capital growth is likely to be fairly pedestrian, but I'm comfortable with this, and will be happy taking the chunky dividend. The share issue was used to reduce borrowing which will enable further expansion where the opportunities present themselves.

Probably also worth noting that during the first half of the year, FSFL produced enough electricity to power 130,000 homes.

Portfolio

The portfolio had a slight fall during October, but was ahead of the wider markets which were pulled down further by some big names posting disappointing updates. The portfolio was down -0.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was down -1.4% over the same period.

Top 3 holdings:

888 Holdings +17%

Dignity +9%

Fulcrum Utilities +7%

Bottom 3 holdings:

Craneware -6%

SAGA -7%

Tate & Lyle -9%

October share purchase: FSFL

Foresight Solar (FSFL) was added to the portfolio in October. As I posted here I've been keeping an eye on renewable energy investment trusts for a while, but have been reluctant to commit due to the premium on most of these. A share issue brought the premium on FSFL this down a little so I decided it was time to invest.

FSFL have 54 solar installations, 50 in the UK and 4 in Australia. They are the largest of the three solar energy investment trusts listed on the FTSE. They listed in 2013, and have generated around 8% total return since IPO, most of which is via dividends which are in excess of 5%.

UK solar subsidies dried up a couple of years ago, since when UK based installations have slowed, so solar funds have looked overseas for attractive investments. Capital growth is likely to be fairly pedestrian, but I'm comfortable with this, and will be happy taking the chunky dividend. The share issue was used to reduce borrowing which will enable further expansion where the opportunities present themselves.

Probably also worth noting that during the first half of the year, FSFL produced enough electricity to power 130,000 homes.

Wednesday 23 October 2019

Renewable energy investment trusts

I’ve been monitoring a number of Investment Trusts providing renewable energy for a while but haven’t yet invested in any. The ITs have continued to have a pretty large premium of 10%+, rarely reducing and I haven't been agile enough (or paying enough attention) to catch the infrequent dips. There are also quite a few listed businesses providing interesting and innovative products that could help contribute to some of the solutions to reducing our use of fossil fuels, but many of these are currently small and still trying to scale their products.

Recent activism by groups concerned by human impact on the climate has put this issue front and centre of many news media agendas. This is understandable when you look at some of the consequences of climate change; the Intergovernmental Panel on Climate Change (IPCC) reporting showing the trend of global warming, and it’s likely impact is here. There’s also plenty of material available via Google, I found this McKinsey report interesting.

There has also been an increase in the publication of articles on how investors can adapt their approach to ensure they are helping to be part of the solution rather than part of the problem. Morningstar recently published a number of articles on ESG (Environmental, Social, Governance) themed investing, just scrolling down their news archive shows how often this crops up, and for a while they have offered a sustainability rating for funds. The Guardian has published several articles on the investment world's reaction to climate change.

Charges:

Recent activism by groups concerned by human impact on the climate has put this issue front and centre of many news media agendas. This is understandable when you look at some of the consequences of climate change; the Intergovernmental Panel on Climate Change (IPCC) reporting showing the trend of global warming, and it’s likely impact is here. There’s also plenty of material available via Google, I found this McKinsey report interesting.

There has also been an increase in the publication of articles on how investors can adapt their approach to ensure they are helping to be part of the solution rather than part of the problem. Morningstar recently published a number of articles on ESG (Environmental, Social, Governance) themed investing, just scrolling down their news archive shows how often this crops up, and for a while they have offered a sustainability rating for funds. The Guardian has published several articles on the investment world's reaction to climate change.

|

| Google Trends: use of the term "esg" in google searches. |

A few options....

I’m not interested in trying to trade stocks, preferring to invest in businesses. Part of my reason for choosing an investment is usually some sort of long term tailwind behind the business. In other words if the business is likely to be bigger and better in 5, 10 or 20 years into the future, then it might be worth investing. It doesn’t have to take over the world, a sensibly run business that throws off plenty of cash is fine with me.

Renewable energy is a sector that clearly has a tailwind, and the IT's focussed on renewables have a number of characteristics that I find appealing, such as generous dividend yields and low volatility. Renewable energy costs have reduced, so the economics now seem to behind renewables too. But how should I assess the potential benefits and pitfalls of the investment trusts giving such easy access to this sector?

I think here we have the starting point for assessing how comfortable I would be investing in these. Factors to consider would include:

Premium/ Discount:

This is the difference between the value of the assets (NAV) and the price at which the shares are being bought and sold. This is the main reason for me holding back on investing. If we make the assumption that the share value will move closer to the NAV over time, then buying at a premium is potentially going to impact negatively on returns. Another related statistic is the average premium at which the shares have traded recently - this isn't available above but can easily be found at various places such as Morningstar.

Gearing:

The investment policy of each of these should detail the approach to borrowing and gearing being used by the business. It's really worth digging into the business reporting and accounts rather than the simple summaries above to get the fine details.

Size:

Premium/ Discount:

This is the difference between the value of the assets (NAV) and the price at which the shares are being bought and sold. This is the main reason for me holding back on investing. If we make the assumption that the share value will move closer to the NAV over time, then buying at a premium is potentially going to impact negatively on returns. Another related statistic is the average premium at which the shares have traded recently - this isn't available above but can easily be found at various places such as Morningstar.

Gearing:

The investment policy of each of these should detail the approach to borrowing and gearing being used by the business. It's really worth digging into the business reporting and accounts rather than the simple summaries above to get the fine details.

Size:

As we can

see the value of assets for each trust varies from Gore street at £28m to

Greencoat UK Wind at £2.7bn. I think this, along with trading volumes should give a clue as to how volatile the trading and price movements of any such investment might be.

Currency:

Currency:

A number of

these trusts have a part of their portfolio outside of the UK, so may be

subject to foreign currency movements and/ or local legal and regulatory

changes that differ from the UK. Two of the trusts operate entirely

outside of the UK – GRP and USFP, so are more exposed to these factors.

Charges:

Ongoing charges are going to directly impact returns so keeping an eye on these is a no-brainer. Some of the charges above are a little eye-watering.

Something not included at the AIC summaries relates to subsidies and the payment structures that these businesses use. A lot of these have been heavily subsidised, both UK and foreign Government approaches to subsidising these developments could impact these businesses as many of them have already invested beyond the UK.

When it comes to payment structures, chewing through the following acronyms: ROC, CFD, FIT, PPA could give you a little indigestion. Power Purchase Agreements (PPAs) help to reduce the volatility of wholesale electricity prices which as you see below can move around a bit:

Ofgem have a number of useful links for understanding the above - of particular interest should be Renewable Obligation Certificates (ROCs).

Other potentially interesting businesses that I have taken a look at are below:

AFC Energy - developing fuel cell technology to use hydrogen to generate electricity

Aggregated Micro Power Holdings - operates renewable energy facilities and finances various decarbonisation projects

Ceres Power - developing fuel cell technology to use various sources including ethanol and hydrogen.

ITM Power - developing technology to use hydrogen as an energy source

John Laing Group - infrastructure investment including renewables

Kingspan Group - manufactures a range of sustainable products for the construction industry

Powerhouse Energy - developing technology to use waste plastics for electricity and hydrogen production

SIMEC Atlantis Energy - renewable energy provider

Nexus Infrastructure - energy infrastructure provider including electrical vehicle charging

Fulcrum Utilitilies - Another energy infrastructure provider including electrical vehicle charging

Terry Smith also has a version of his famous Fundsmith now with an ESG flavour, which I only recently noticed.

I have a small position in Fulcrum Utilities, keeping an eye on the rest.

If anyone is particularly interested in investing in companies contributing to renewable energy I suggest checking out the diyinvestor blog for some excellent reading material.

Ofgem have a number of useful links for understanding the above - of particular interest should be Renewable Obligation Certificates (ROCs).

Other potentially interesting businesses that I have taken a look at are below:

AFC Energy - developing fuel cell technology to use hydrogen to generate electricity

Aggregated Micro Power Holdings - operates renewable energy facilities and finances various decarbonisation projects

Ceres Power - developing fuel cell technology to use various sources including ethanol and hydrogen.

ITM Power - developing technology to use hydrogen as an energy source

John Laing Group - infrastructure investment including renewables

Kingspan Group - manufactures a range of sustainable products for the construction industry

Powerhouse Energy - developing technology to use waste plastics for electricity and hydrogen production

SIMEC Atlantis Energy - renewable energy provider

Nexus Infrastructure - energy infrastructure provider including electrical vehicle charging

Fulcrum Utilitilies - Another energy infrastructure provider including electrical vehicle charging

Terry Smith also has a version of his famous Fundsmith now with an ESG flavour, which I only recently noticed.

I have a small position in Fulcrum Utilities, keeping an eye on the rest.

If anyone is particularly interested in investing in companies contributing to renewable energy I suggest checking out the diyinvestor blog for some excellent reading material.

Tuesday 1 October 2019

September 2019 portfolio update

Another volatile month, with crazy oil price movements, Trumpy being naughty, Bojo and Parliament butting heads over the tediousness that is Brexit. Some price reductions in some of the big defensive blue chips piqued the interest, but they aren't quite into buying territory. My guess is that some of the selling was due to Sterling showing signs of life, but also people moving out of the big international defensive stocks and into more UK facing businesses. I expect the portfolio exposure to big internationals will result in some share price decreases over the short term, I'm comfortable with that as I believe it is outweighed by long term benefits.

Portfolio

The portfolio was pretty much flat during September, just about getting into the positive, but behind the wider markets which were considerably more frisky. The portfolio was up 0.3% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 3% over the same period.

Leaping like a salmon this month was Craneware (CRW) +40%. There didn't seem to be an obvious reason, maybe an institutional investor got interested, short covering...who knows.

Somero Enterprises (SOM) flopped -34% during the month after another soggy trading update that left investors less than impressed.

September share purchase: TEP

Telecom Plus (TEP) was a new entry to the portfolio this month. It got a brief mention when I took a look at some telecoms companies here, but not in any detail as (despite being listed by the LSE as a telecommunications firm) telecoms is only a part of it’s business. If you have a rummage on the internet you’ll find it calling itself Utility Warehouse – which is a relatively apt name for it. It makes money by providing a range of utility and "utility like" services, such as phone lines, mobile network, internet etc. However, it doesn’t build and manage the infrastructure - the pipes and wires - as such, but connects customers to the service providers, then manages the customer facing aspects such as support and billing. In this way it manages to offer some utility like defensive qualities, but also manages to avoid the huge capital costs that utilities and/or telecoms providers get saddled with. It has also managed to keep marketing and sales costs low by offering existing customers a chance of earning cash by getting them to sign up new customers.

Portfolio

The portfolio was pretty much flat during September, just about getting into the positive, but behind the wider markets which were considerably more frisky. The portfolio was up 0.3% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 3% over the same period.

Leaping like a salmon this month was Craneware (CRW) +40%. There didn't seem to be an obvious reason, maybe an institutional investor got interested, short covering...who knows.

Somero Enterprises (SOM) flopped -34% during the month after another soggy trading update that left investors less than impressed.

September share purchase: TEP

Telecom Plus (TEP) was a new entry to the portfolio this month. It got a brief mention when I took a look at some telecoms companies here, but not in any detail as (despite being listed by the LSE as a telecommunications firm) telecoms is only a part of it’s business. If you have a rummage on the internet you’ll find it calling itself Utility Warehouse – which is a relatively apt name for it. It makes money by providing a range of utility and "utility like" services, such as phone lines, mobile network, internet etc. However, it doesn’t build and manage the infrastructure - the pipes and wires - as such, but connects customers to the service providers, then manages the customer facing aspects such as support and billing. In this way it manages to offer some utility like defensive qualities, but also manages to avoid the huge capital costs that utilities and/or telecoms providers get saddled with. It has also managed to keep marketing and sales costs low by offering existing customers a chance of earning cash by getting them to sign up new customers.

ROCE has been in double digits over recent years, net profit

has not been as high as I would like, but I’m prepared to ignore that given

the defensive qualities of the business. They also have a reasonable dividend –

clocking in above 4%, with regular annual increases, and low levels of debt. They

seem to make a habit of getting awards for keeping customers happy, and have

seen their customer numbers growing which is encouraging. I don’t see this as a

fast growing business, but if they can keep slowly adding customers, keeping

them happy, and increasing the dividend I’ll be content.

As with any utility company in the UK, it might well find

itself in the cross hairs of a Labour government, should they get themselves

into power. As an interface to utility providers, they probably wouldn’t fall

into the bracket of “things Labour want to nationalise”, but any risk of labour

treating this sort of business as a political football is unlikely to be

reflect well in the share price. Since some of their profits are being paid to me, I might as well

contribute to them by switching a few of my bills across to them too.

Subscribe to:

Posts (Atom)