There are plenty of articles and tools on the web to show

the importance of compounding when it comes to owning shares, but I like to try

to work through these things in my own way to try to get a better understanding

of them.

In order to do that I took three theoretical shares with

different “profiles” and indulged in a little time travel. Each of the shares

have an average “growth return” across share price growth, dividend yield and

dividend growth of 3.5%.

The first is a “balanced” stock, representing a business

growing slowly, generating a steady supply of spare cash to help grow the

business and also able to offer a reasonable dividend that it can grow

consistently. I think a suitable example would be Unilever or Diageo.

Stock 1: Balanced

Share price growth

|

3%

|

Dividend

|

3%

|

Dividend growth

|

5%

|

Average growth

|

3.5%

|

The second is a “growth” stock, representing a business wanting

to reinvest most of it’s spare cash back into the business, but still

maintaining a small dividend and little dividend growth. Examples of this type

would be Ocado, or NMC Health.

Stock 2: Growth

Share price growth

|

8%

|

Dividend

|

1%

|

Dividend growth

|

2%

|

Average

|

3.5%

|

The third is an “income” stock, representing a business that

is struggling to grow, but generating lots of cash that it returns to

shareholders as dividends. Maybe the zero % growth looks odd, but lets assume

the price oscillates around a central

point. I think businesses such as Shell or HSBC would fall into this category.

Stock 3: Income

Share price growth

|

0%

|

Dividend

|

7%

|

Dividend growth

|

4%

|

Average

|

3.5%

|

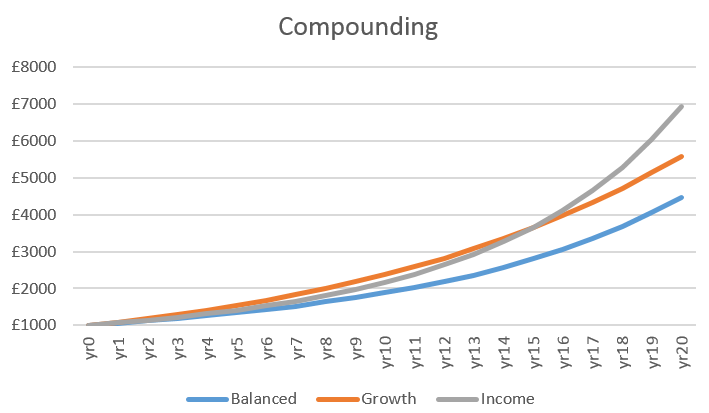

My investment into each of the above businesses is £1000, which is untouched for 20 years. Over that time, all dividend payments are

reinvested by buying more shares of the same business. To make life

easier, I’m assuming no taxes, and no transaction fees.

Clearly no stock would rise by the same amount each year,

there would be ups and downs, maybe dividend cuts, or additional payments. As

the fictional “growth” business grows it’s rate of growth would slow…there are

all sorts of caveats that could be built in, but I’m not going to because it’s

a nice tidy thought experiment…

The results are interesting:

Balanced

|

Growth

|

Income

|

|

Total change

|

348%

|

459%

|

593%

|

Annualised total return

|

7.8%

|

9.0%

|

10.2%

|

|

| share price compounding experiment |

So what’s my conclusion – look for a big dividend?

As most commentators tell us, the dividend has to be sustainable.

This is even more evident once the time span is stretched out to 20 years, and yet more if the share

price isn’t going anywhere. So how do we get sustainable dividends – by buying

into well managed businesses. But also businesses that should be able to continue chugging away indefinitely.

My conclusion, quality businesses are the target, not any

particular business “profile”. If I invest in quality, I can sleep at night, in

fact I’d like to think that I can just buy the shares and forget about them.

I’m not convinced everything in my portfolio is a quality

investment, but thankfully I’m comfortable that my main investments are. Whenever

I check my portfolio, I’m always drawn to those shares I’m not confident in. I often

forget to check those quality businesses, but whenever I do, I usually find they

are slowly but surely increasing in value.