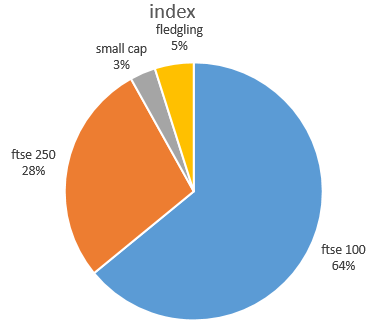

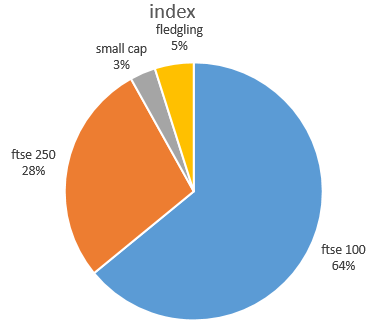

As you can see the portfolio at the start of the year consists mostly of investments in large FTSE 100 businesses, the next largest chunk is with FTSE 250, and a sprinkling of smaller investments.

|

| portfolio spread across indices |

It's ended up like this more or less by accident, but I'm actually pretty happy with this structure. I'm going to aim to have no more than 10% invested in smaller business to hopefully reduce risk and volatility.

I will also be investing in businesses listed overseas, and have my eye on a few US investments. I'm holding off for the moment until the Dollar vs Sterling rate improves, and I also suspect the US markets are likely get a little cheaper throughout the year.

In the meantime geographical diversification is via international businesses listed on the FTSE.

No comments:

Post a Comment