Plenty of things pushing the markets around over the last month, Trumpy tariffs, Bojo's Brexit plans, Iran, Hong Kong...as a consequence we've seen plenty of volatility. Some of this is going to start hitting business performance, so it's no surprise to see investors getting nervous. Since I'm looking to buy, this is not a wholly bad state of affairs from my point of view. If Mr Market has a few tantrums over the next few months that will hopefully provide a few discounts, and the chance to lock in some higher dividend yields.

However, I'm remaining cautious particularly since Brexit feels somewhat binary: a softer version is likely to cause Sterling to spike, and drop the prices of the big international firms; whereas a harder Brexit is likely to cause a bit of a sell off of UK facing businesses. I'm not too concerned about the long term, but would be nice to be able to capitalise on cheaper prices and bigger dividends. I have plenty of interesting businesses and trusts to research, anything looking relatively Brexit-proof may well make it onto the shopping list.

Portfolio

The portfolio was beaten up a bit during August, like the wider markets, but just sneaked in ahead of my benchmark. The portfolio was down -3.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was down -3.9% over the same period.

Sprinting ahead this month was old timer Unilever (ULVR), +5%. It's not often ULVR gets up above walking pace, but managed it this month. I suspect it's a result of people diving into defensive stocks to escape the volatility.

AG Barr (BAG) wasn't so steady on it's feet and took a tumble this month, -13%. Not too concerning just bouncing around after the big price drop last month from what I can tell. Nice to see the firm capitalising on the price and indulging in buy back activity, tick in the box for BAG.

August share purchase:

Network International (NETW) are a digital payment provider operating across the Middle East and Africa. They listed on the FTSE earlier this year - their IPO was in April. This is an unusual one for me, as I would rather a company had been operating as a listed business for a while to make sure any skeletons in the cupboard from their private days had been appropriately dealt with. So, as with any purchase that I think is a little racy, to mitigate some of that risk I've taken a smaller position.

NETW are based out of Dubai, and following the IPO have a valuation over £2.8bn, so they are not exactly a minnow, comfortably nestled in the FTSE 250 amongst household names such as Cineworld. However, compared to the $43bn paid by FIS for Worldpay recently they have some much bigger firms to compete with. It is this sector consolidation and the defensive nature of the payments industry that drove the purchase. I was also encouraged to see Mastercard take a 10% stake at the IPO. I'm not keen on buying at IPOs simply because it's never clear if the price is going to shoot upwards or crash. NETW has been moving upwards and following a recent positive trading update I was convinced to put in a little money. If it continues it's good news I will put in a bit more.

Sunday 1 September 2019

Wednesday 21 August 2019

Time in the market

Time in the market vs. Timing the market

A quick google of sensible places to invest one's excess cash quickly brings back article after article extolling the virtues of the stock market. The Barclays gilt study tells us that over the long term investing in the stock market provides the greatest return over other asset classes. That takes care of where to invest. But how should I do it?

This is usually presented as the need to decide on one of two approaches:

- Time in the market

- Timing the market

Time in the market

On one side there is the buy and hold camp – who suggest drip feeding a small amount regularly into your investments. Don’t look at the news. Come back in a few years to a (hopefully) healthy pile of profits. Time in the market is more important than trying to time the market, because people typically aren’t very good at it. And we’re told that missing the small number of best trading days have a massive impact on returns.

Timing the market

In the other

camp are those that advocate more activity, not necessarily trying

to flip stocks over short time frames, but buying and holding for a while,

then sell for a profit. In other words, not simply time in the market, but

timing it. After all if you suspect that your investments have peaked, why sit there and watch those profits all disappear as Mr Market throws a tantrum?

I’m a UK investor and my starting point is the London stock market, I'll take the FTSE100 as it's the driving force behind the UK indices – as I’ve noted here the UK indices have a few interesting characteristics. But it’s where the majority of my investments are, and will likely continue to be, so that's where I'll focus my attention.

I’ve taken monthly data for 10 years, the last 10 full years from 2009 – 2018. It turns out that across that period, the biggest monthly gains are between 6% and 8.5%. There are 11 months that fall into that size of gain, 7 of them in 2009 and 2010, perhaps reflecting the recovery from the financial crisis. (I’m ignoring dividends for this)

The gain from 2009 – 2018 was around 47%, a £10000 investment would have increased to £14749.

Missing those 11 months would indeed have a significant impact on the investment. It would have resulted in a loss, -30%. The same £10000 would have ended up being worth £7045.

|

| FTSE100 2009 to 2018 missing the best months |

|

| FTSE100 2009 to 2018 missing the worst months |

My activity

is limited, partly through having a job and a family and therefore relatively limited time to dedicate to doing this. In part it’s fear and

laziness. I feel I would need a scientific and systematic approach,

and don’t really know where to start. So I’m more

in the camp of simply leaving money invested in (hopefully) good companies, and

just leaving those investments to do their thing. As I noted here, had I tried to time the market when we had a big market sell off towards the end of 2018, I'm not sure when I would have jumped back in once I'd sold. So I guess I'm a time in the market kind of

chap, at least for the moment.

Friday 2 August 2019

July 2019 portfolio update

Lots of companies giving updates during July, so some quite big price moves both up and down, but the markets were maintaining their overall upwards trend. A few of the price moves put some things on the shopping list into buying territory which was helpful. Many of the big cap stocks that I'd prefer to be buying are still looking expensive, helped in part by the devaluation of Sterling. But I shall keep an eye on them as one or two have wobbled over the last few weeks.

Portfolio

The portfolio followed the markets upwards during July, just about getting it's nose in front. The portfolio was up 3% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 2.3% over the same period.

Keen bean this month was Fulcrum Utilities (FCRM), +16%. I suspect this is partly due to over-enthusiastic selling last month when preliminary results were delayed, but an update stating that they were trading in line with expectations was welcomed.

Dignity (DTY) was showing a distinct lack of enthusiasm this month, -17% due mainly to a poor trading update and withdrawing their interim dividend. Not enough people dying apparently.

July share purchase 1: CRW

Craneware (CRW) develop software to help US hospitals and healthcare providers to understand their costs, maintain regulatory compliance, avoid pricing errors and streamline their administration. They were founded in 1999 and listed on the AIM in 2007, and have been a bit of an investor darling ever since, now with a market cap around £530m.

Despite deriving it's revenues from the US, the business is based in Edinburgh and have some great

operating numbers, including ROCE and net margins averaging over 20% across the last 10 years, and zero debt. Customers typically enter 5 year contracts and provide nice predictable revenues. As a consequence of Craneware providing such an attractive investment proposition, the price has been chased ever higher. So when the company announced it's sales were off course at the end of June, the price took a nosedive of over 35%.

The price basically reversed out it's gains over the last year in a matter of hours on publication of the trading announcement. I'd be quite happy to see a slow recovery, if the price gains 10% in each of the next 5 years it will have got back to where it started before announcing the slow sales. Craneware has a sticky customer base and operates at the intersection of technology and healthcare which are sectors in which I'm comfortable investing, however the price is still high in my view (at least in PE terms, less so if you're looking at price to cash flow). Given the high price, I've kept the investment small, recycling a chunk of dividend payments into this one.

July share purchase 2: BAG

AG Barr sell soft drinks - and have since 1875 built their business of adding sugar and flavourings to water, and in some cases some carbon dioxide for a little fizz. They have a number of brands, the most famous of which is Irn Bru, but they have also branched out into juices, waters, cocktail mixers, and partnerships with other soft drinks sellers including (my favourite) Bundaberg ginger beer.

The Barr family ran the business for over 100 years, and still have family members in senior management. Robin Barr serves as a non-executive director and owns around 5% of the business. It is also a favourite of a number of funds, including Lindsell Train who own around 14% of the business.

It's not difficult to see why it has proven an attractive investment, it is a simple business, which has been successfully and conservatively run for quite some time. Over the last decade it has averaged double digit ROCE and net margins, and has no debt. It also has a proud track record of dividend increases, which again over the last decade have averaged 5% increase per year.

Food and drink businesses are typically seen as defensive investments, steady earners that can rely on many small repeat transactions. AG Barr's share price has indeed been increasing steadily, and from October 2016 until June 2019, more or less doubled. Much like Craneware above, with the valuation getting into nosebleed territory (at least for BAG), there was little room for error. So when AG Barr released a profit warning in the middle of the month, the sell off sliced 30% from the share price, to a level it was selling for in 2014. The reasons given included a couple of poor performers in their portfolio, the sugar tax, and a subsequent change in strategy to focus on volumes. And the weather. I'm not impressed by any business that relies on the UK weather for it's sales. However, having a couple of underperforming products is forgivable, and driving volumes and increasing marketing spend at the expense of margins is understandable given the altered recipes to accommodate the sugar tax.

I don't think the price drop put it into bargain territory, but shifted it from overvalued to reasonably priced, which is good enough for me.

Portfolio

The portfolio followed the markets upwards during July, just about getting it's nose in front. The portfolio was up 3% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 2.3% over the same period.

Keen bean this month was Fulcrum Utilities (FCRM), +16%. I suspect this is partly due to over-enthusiastic selling last month when preliminary results were delayed, but an update stating that they were trading in line with expectations was welcomed.

Dignity (DTY) was showing a distinct lack of enthusiasm this month, -17% due mainly to a poor trading update and withdrawing their interim dividend. Not enough people dying apparently.

July share purchase 1: CRW

Craneware (CRW) develop software to help US hospitals and healthcare providers to understand their costs, maintain regulatory compliance, avoid pricing errors and streamline their administration. They were founded in 1999 and listed on the AIM in 2007, and have been a bit of an investor darling ever since, now with a market cap around £530m.

Despite deriving it's revenues from the US, the business is based in Edinburgh and have some great

operating numbers, including ROCE and net margins averaging over 20% across the last 10 years, and zero debt. Customers typically enter 5 year contracts and provide nice predictable revenues. As a consequence of Craneware providing such an attractive investment proposition, the price has been chased ever higher. So when the company announced it's sales were off course at the end of June, the price took a nosedive of over 35%.

The price basically reversed out it's gains over the last year in a matter of hours on publication of the trading announcement. I'd be quite happy to see a slow recovery, if the price gains 10% in each of the next 5 years it will have got back to where it started before announcing the slow sales. Craneware has a sticky customer base and operates at the intersection of technology and healthcare which are sectors in which I'm comfortable investing, however the price is still high in my view (at least in PE terms, less so if you're looking at price to cash flow). Given the high price, I've kept the investment small, recycling a chunk of dividend payments into this one.

July share purchase 2: BAG

AG Barr sell soft drinks - and have since 1875 built their business of adding sugar and flavourings to water, and in some cases some carbon dioxide for a little fizz. They have a number of brands, the most famous of which is Irn Bru, but they have also branched out into juices, waters, cocktail mixers, and partnerships with other soft drinks sellers including (my favourite) Bundaberg ginger beer.

The Barr family ran the business for over 100 years, and still have family members in senior management. Robin Barr serves as a non-executive director and owns around 5% of the business. It is also a favourite of a number of funds, including Lindsell Train who own around 14% of the business.

It's not difficult to see why it has proven an attractive investment, it is a simple business, which has been successfully and conservatively run for quite some time. Over the last decade it has averaged double digit ROCE and net margins, and has no debt. It also has a proud track record of dividend increases, which again over the last decade have averaged 5% increase per year.

Food and drink businesses are typically seen as defensive investments, steady earners that can rely on many small repeat transactions. AG Barr's share price has indeed been increasing steadily, and from October 2016 until June 2019, more or less doubled. Much like Craneware above, with the valuation getting into nosebleed territory (at least for BAG), there was little room for error. So when AG Barr released a profit warning in the middle of the month, the sell off sliced 30% from the share price, to a level it was selling for in 2014. The reasons given included a couple of poor performers in their portfolio, the sugar tax, and a subsequent change in strategy to focus on volumes. And the weather. I'm not impressed by any business that relies on the UK weather for it's sales. However, having a couple of underperforming products is forgivable, and driving volumes and increasing marketing spend at the expense of margins is understandable given the altered recipes to accommodate the sugar tax.

I don't think the price drop put it into bargain territory, but shifted it from overvalued to reasonably priced, which is good enough for me.

Saturday 27 July 2019

Dividends vs. drawdowns

Dividends vs. drawdowns

I read this Terry Smith article some time ago (also available on the FT site here), and thought I should finally get around to digging into it a bit more. I think you can question the merits of using price to book as an appropriate metric, particularly with low capital companies who generate cash with few physical assets. I’m sure you could also disappear down a rabbit hole attempting to analyse retained earnings for a bunch of companies, particularly a disparate collection such as those in Fundsmith. But I am most interested in the distinction between using dividends for an income stream versus selling fund units (or one’s shares) as a means to generate income - to quote the article:

Income dilemma

FTSE 100 distribution tracker:

As might be expected, dividends being reinvested automatically into the accumulation fund, and the wonders of compounding provide for a much better performance. The additional 16% that the accumulation fund provides sounds a little abstract, but an additional £16k in the bank certainly isn’t.

In other words, generating an income through dividends, or taking a slice of the fund gives pretty much the same result. Changing the timing of unit sales would affect the returns, but if this was my income I wouldn’t necessarily be able to delay paying bills to wait for a favourable price at which to sell units.

This also doesn’t take into account fees, for the two funds I’ve chosen the ongoing charges are the same, but depending on the platform in which you choose to invest, transaction fees would nibble away at the small advantage that the accumulation fund offers. There is also the hassle of having to sell the units etc. not a big deal maybe, but compared to simply receiving a quarterly dividend in your bank account, it’s an effort that can be avoided.

So it doesn't look like the assertion from the article above holds much water in this particular example. At the time of writing the FTSE 100 ETF has a yield of 4.4%, and as can be seen here, aside from the financial crash years around 2009, the current yield is at the upper end of it's historic range. Fundsmith Income fund has a much lower yield of around 1.5%. Lets see how the Fundsmith accumulation fund would fare providing the same income as the FTSE 100 tracker, if I had to sell off units of Fundsmith.

Mr Smith vs the index

Fundsmith launched in November 2010, 10 months or so after the launch date of the iShares accumulation fund above, so I will adjust the unit sales to match. Basic stats as above to start with:

Fundsmith accumulation:

Now if I sell units to provide for the same dividend income as the FTSE 100 distribution tracker above we get the following:

Even when Fundsmith has to pay out an additional few percentage points in income to match the FTSE 100 ETF the differences are pretty stark. Selling the units would give the same income as the tracker, but the capital is up over 260% compared to the 41% of the tracker. Using this second example, the approach outlined in Mr Smith's article appears convincing.

I read this Terry Smith article some time ago (also available on the FT site here), and thought I should finally get around to digging into it a bit more. I think you can question the merits of using price to book as an appropriate metric, particularly with low capital companies who generate cash with few physical assets. I’m sure you could also disappear down a rabbit hole attempting to analyse retained earnings for a bunch of companies, particularly a disparate collection such as those in Fundsmith. But I am most interested in the distinction between using dividends for an income stream versus selling fund units (or one’s shares) as a means to generate income - to quote the article:

"The need to get spending money from your investments once you've retired is obvious. But why does it have to come from dividends?"

If I had an investment that paid out 4%, something like a FTSE 100 tracker, how would taking the 4% dividend compare to selling units to generate the same income? The FTSE 100 hasn't performed particularly well over recent years compared to other indices, whereas in terms of capital growth Fundsmith has been one of the better places to park your cash. It's only a small sample, but comparing these two investments, let's see how Mr Smith's assertion stacks up.

If I had an investment that paid out 4%, something like a FTSE 100 tracker, how would taking the 4% dividend compare to selling units to generate the same income? The FTSE 100 hasn't performed particularly well over recent years compared to other indices, whereas in terms of capital growth Fundsmith has been one of the better places to park your cash. It's only a small sample, but comparing these two investments, let's see how Mr Smith's assertion stacks up.

Income dilemma

I’m starting from a position that I need my investments to provide me with some

income. There are two ways I can generate this:

- Have an investment that pays out a steady dividend

- Sell a slice of my investments at regular intervals

I’m going to take the FTSE 100 as my initial virtual investment – or

more precisely a couple of iShares index funds to compare, one an accumulation fund that automatically

reinvests dividends, one a distribution fund that pays out dividends quarterly.

I begin with an imaginary £100000 (just because it's a nice round number). I have wound back the clock to January 2010 when the accumulation

fund I’ve chosen was started, and tracked performance forward from there until

the end of June 2019. To make life easier I’m ignoring fees.

The capital of the distribution fund will remain untouched,

and the dividends are not reinvested. For the accumulation fund I will sell as

many units as I need to generate the same income provided by dividends from the

distribution fund. I will also sell these units in the same months as the

dividends are paid out.

Lets start with some stats showing how the trackers

performed before I sell any units.

FTSE 100 accumulation tracker:

- Starting value January 2010: £100000

- End value June 2019: £200829

- Total return % change: 101% increase

- Total return: £100829

FTSE 100 distribution tracker:

- Starting value January 2010: £100000

- End value June 2019: £140647

- Capital % change: 41% increase

- Dividends paid: £43941

- Total difference (capital + dividends): 85% increase

- Total return: £84588

As might be expected, dividends being reinvested automatically into the accumulation fund, and the wonders of compounding provide for a much better performance. The additional 16% that the accumulation fund provides sounds a little abstract, but an additional £16k in the bank certainly isn’t.

But I need an income, so how does the accumulation tracker

compare as an investment if I need to sell off quarterly slices in order to pay

the bills?

Accumulation tracker:

- Starting value January 2010: £100000

- End value June 2019: £141389

- Capital % change: 41% increase

- Total value of units sold: £43941

- Total difference (capital + dividends): 85% increase

- Total return: £85330

In other words, generating an income through dividends, or taking a slice of the fund gives pretty much the same result. Changing the timing of unit sales would affect the returns, but if this was my income I wouldn’t necessarily be able to delay paying bills to wait for a favourable price at which to sell units.

This also doesn’t take into account fees, for the two funds I’ve chosen the ongoing charges are the same, but depending on the platform in which you choose to invest, transaction fees would nibble away at the small advantage that the accumulation fund offers. There is also the hassle of having to sell the units etc. not a big deal maybe, but compared to simply receiving a quarterly dividend in your bank account, it’s an effort that can be avoided.

So it doesn't look like the assertion from the article above holds much water in this particular example. At the time of writing the FTSE 100 ETF has a yield of 4.4%, and as can be seen here, aside from the financial crash years around 2009, the current yield is at the upper end of it's historic range. Fundsmith Income fund has a much lower yield of around 1.5%. Lets see how the Fundsmith accumulation fund would fare providing the same income as the FTSE 100 tracker, if I had to sell off units of Fundsmith.

Mr Smith vs the index

Fundsmith launched in November 2010, 10 months or so after the launch date of the iShares accumulation fund above, so I will adjust the unit sales to match. Basic stats as above to start with:

Fundsmith accumulation:

- Starting value November 2010: £100000

- End value June 2019: £453020

- Total return % change: 353% increase

- Total return: £353020

Now if I sell units to provide for the same dividend income as the FTSE 100 distribution tracker above we get the following:

- Starting value November 2010: £100000

- End value June 2019: £360616

- Capital % change: 261% increase

- Total value of units sold: £41444

- Total difference (capital + dividends): 302% increase

- Total return: £302060

Even when Fundsmith has to pay out an additional few percentage points in income to match the FTSE 100 ETF the differences are pretty stark. Selling the units would give the same income as the tracker, but the capital is up over 260% compared to the 41% of the tracker. Using this second example, the approach outlined in Mr Smith's article appears convincing.

Friday 5 July 2019

2019 Mid-year review

As we’re past the half way point of 2019 I thought I should reflect on how the portfolio has performed and how I’ve progressed against my goals during the first 6 months of the year.

Portfolio performance

So far in 2019 the portfolio has increased in value by 15.1% (including all costs, and dividend payments). This compares to an increase of 13.4% in my benchmark (also including costs – as an accumulation fund dividends are reinvested automatically). I'm obviously pleased by this but a number of larger holdings, such as Unilever, have been performing very strongly of late and I would expect them to take a breather at some point soon.

The dividend yield from my portfolio in 2019 has amounted to 1.84% so far. The dividend yield on my benchmark is 3.79%, if half of this had been paid out in the first 6 months of the year, that would amount to a yield of around 1.9%. So I’m not too far away, however, a larger proportion of dividends tend to get paid out in the first half of the year, so I may drift from this. I would prefer the portfolio yield to be higher, but not at the expense of quality.

The best performer in the portfolio so far this year has been Sage, but this possibly reflects an overdone sell off last year, rather than any stellar turnaround from the business. Worst performer has been Saga, presenting a dire set of results that gave the impression the management had been asleep at the wheel. Whilst there are a few laggards in the portfolio, Saga is the only one at the moment looking like getting the elbow.

Analysis

I’ve been adding to the toolset, but it’s too early to say if this is proving effective. I’ve added in cost of capital calculations, and started to analyse performance metrics in a similar way to Terry Smith in his annual letters to investors in Fundsmith. I now have some weighted average performance metrics, and the median for the same metrics for the portfolio. In this way I can get a view of the portfolio as if it was a business, and how it compares to other businesses and potential investments. So an additional consideration for adding to the portfolio is to invest in companies that have performance metrics that compare favourably to those already in the portfolio, and the portfolio as a whole. Some of the key portfolio performance metrics are below:

Whilst the above stats are helpful in some respects, using them to evaluate a Real Estate Investment Trust (REIT) is a little tricky as REITs are structured differently to most businesses. So I have excluded BBOX from the above. Also the debt related stats are not necessarily a sound reflection of the distribution of the debt across the portfolio. A number of holdings have no borrowings, it is mostly concentrated in a small number of holdings. Going forward, debt will continue to be an important factor in deciding whether to add something to the portfolio, I will prefer any additions to have low levels of borrowings.

Buying and selling

So far this year I've made the following purchases:

Goals

My initial investment goals were:

Portfolio performance

So far in 2019 the portfolio has increased in value by 15.1% (including all costs, and dividend payments). This compares to an increase of 13.4% in my benchmark (also including costs – as an accumulation fund dividends are reinvested automatically). I'm obviously pleased by this but a number of larger holdings, such as Unilever, have been performing very strongly of late and I would expect them to take a breather at some point soon.

The dividend yield from my portfolio in 2019 has amounted to 1.84% so far. The dividend yield on my benchmark is 3.79%, if half of this had been paid out in the first 6 months of the year, that would amount to a yield of around 1.9%. So I’m not too far away, however, a larger proportion of dividends tend to get paid out in the first half of the year, so I may drift from this. I would prefer the portfolio yield to be higher, but not at the expense of quality.

The best performer in the portfolio so far this year has been Sage, but this possibly reflects an overdone sell off last year, rather than any stellar turnaround from the business. Worst performer has been Saga, presenting a dire set of results that gave the impression the management had been asleep at the wheel. Whilst there are a few laggards in the portfolio, Saga is the only one at the moment looking like getting the elbow.

Analysis

I’ve been adding to the toolset, but it’s too early to say if this is proving effective. I’ve added in cost of capital calculations, and started to analyse performance metrics in a similar way to Terry Smith in his annual letters to investors in Fundsmith. I now have some weighted average performance metrics, and the median for the same metrics for the portfolio. In this way I can get a view of the portfolio as if it was a business, and how it compares to other businesses and potential investments. So an additional consideration for adding to the portfolio is to invest in companies that have performance metrics that compare favourably to those already in the portfolio, and the portfolio as a whole. Some of the key portfolio performance metrics are below:

Weighted

average

|

||||||

roce

|

gross

margin

|

operating

margin

|

net

margin

|

cash

conversion

|

debt:

ebit

|

cash

flow yield

|

18.7%

|

47.7%

|

17.0%

|

13.4%

|

46.5%

|

3.5

|

2.2%

|

Median

|

||||||

roce

|

gross

margin

|

operating

margin

|

net

margin

|

cash

conversion

|

debt:

ebit

|

cash

flow yield

|

17.6%

|

57.0%

|

21.0%

|

16.1%

|

96.7%

|

2.8

|

5.6%

|

Whilst the above stats are helpful in some respects, using them to evaluate a Real Estate Investment Trust (REIT) is a little tricky as REITs are structured differently to most businesses. So I have excluded BBOX from the above. Also the debt related stats are not necessarily a sound reflection of the distribution of the debt across the portfolio. A number of holdings have no borrowings, it is mostly concentrated in a small number of holdings. Going forward, debt will continue to be an important factor in deciding whether to add something to the portfolio, I will prefer any additions to have low levels of borrowings.

Buying and selling

So far this year I've made the following purchases:

- Tritax Big Box (January)

- Manx Telecom (January)

- Fulcrum Utilities (March)

- Abcam (April)

- Reckitt Benckiser (April)

- Somero Enterprises (June)

These are all new additions to the portfolio, I haven't topped up any existing holdings.

Manx Telecom was acquired shortly after I invested, leaving the portfolio for a 32% profit. I have not sold any other shares.

Goals

My initial investment goals were:

- Capital preservation

- Increase capital by more than the rate of inflation

- Invest in quality dividend paying stocks

And by careful selection of stocks and funds, to outperform the FTSE All Share Index. Ultimately I'd like to be in a position in 20 years to get a steady income from dividends to top up pensions, and a solid portfolio of investments to pass on to sleepy junior, to provide not just a lump of cash, but a revenue stream. So far I'm fairly pleased with performance against these goals, but it's very early days.

Personal finance

No need to access the emergency fund during the first half of the year, and we've added to it slightly. Getting this set up has proved a great foundation for the rest of our finances as we now know that any spare cash is genuinely surplus to requirements.

Mortgage overpayments have continued. Mortgage partA is on track to disappear in around 3 years thanks to maxing out the overpayments. This accounts for about 60% of our mortgage payments, so completing this would free up a nice extra chunk of disposable income. We could then decide whether to put this to work overpaying the remainder of Mortgage partB, to a large extent this will depend on interest rates at the time. We have a bit of cash from bonuses, some of which is going into some work on the house, if this comes in under budget then Mortgage partB might get a little extra too.

Arrival of sleepy junior 2 over the winter will likely take a slice out of the budget, but nothing too dramatic as an attic full of stuff used by sleepy junior 1 can get wheeled out.

Conclusion

Fairly pleased with the start to the year, with a decent performance from the portfolio. I don't expect it to continue throughout the second half the year, as the high performing stocks are going to ease off at some point, macro-economic conditions look wobbly, and Brexit will once again take centre stage in the Autumn.

I've noticed myself prevaricating quite a lot over a number of purchases, and tend to want to get a bit more data, crunch some more numbers. Whilst caution and care is a positive, I think there has been a little too much dithering at times. However, overall, I'm pretty comfortable with the investments in the portfolio.

Personal finance

No need to access the emergency fund during the first half of the year, and we've added to it slightly. Getting this set up has proved a great foundation for the rest of our finances as we now know that any spare cash is genuinely surplus to requirements.

Mortgage overpayments have continued. Mortgage partA is on track to disappear in around 3 years thanks to maxing out the overpayments. This accounts for about 60% of our mortgage payments, so completing this would free up a nice extra chunk of disposable income. We could then decide whether to put this to work overpaying the remainder of Mortgage partB, to a large extent this will depend on interest rates at the time. We have a bit of cash from bonuses, some of which is going into some work on the house, if this comes in under budget then Mortgage partB might get a little extra too.

Arrival of sleepy junior 2 over the winter will likely take a slice out of the budget, but nothing too dramatic as an attic full of stuff used by sleepy junior 1 can get wheeled out.

Conclusion

Fairly pleased with the start to the year, with a decent performance from the portfolio. I don't expect it to continue throughout the second half the year, as the high performing stocks are going to ease off at some point, macro-economic conditions look wobbly, and Brexit will once again take centre stage in the Autumn.

I've noticed myself prevaricating quite a lot over a number of purchases, and tend to want to get a bit more data, crunch some more numbers. Whilst caution and care is a positive, I think there has been a little too much dithering at times. However, overall, I'm pretty comfortable with the investments in the portfolio.

Friday 28 June 2019

June 2019 portfolio update

June saw a recovery after the May mini-selloff, a shame in a way as a few things on the shopping list were starting to have attractive prices. Unfortunately I was a bit sluggish, other people noticed and they started getting bought again. As a result I have quite a bit of dry powder to deploy, I'm sure the crazy gang of Trump, Johnson and Hunt will help the markets move back into buying territory before long.

Portfolio

The portfolio followed the wider markets and bounced back up this month, not with quite the same vigour but I'm pleased with it. The portfolio was up 3.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 3.7% over the same period.

June prefect award goes to 888 (888), +24% following a positive trading update and a capital markets event that seemed to keep investors and analysts happy.

The dunce hat this month is with Fulcrum Utilities (FCRM), -15% due to a set of preliminary results that were delayed until July, due to some tricky sums. Unsurprisingly investors didn't react well.

June share purchase: SOM

Somero Enterprises (SOM) sell equipment to help make sure that when you're laying a concrete floor, that it's level. Really level. They are a US based business, with their HQ in Florida, and they make 69% of their money in the US. Despite this they are listed on the London AIM with a market cap around £160m.

They have been in business since 1986 and listed on the LSE in 2006. They have a great set of operating numbers, including over the last 5 years, ROCE averaging over 30%, net margins averaging over 20%, and zero debt. At the start of the year they reported a record order book, and things were looking very rosy, then severe rain hit a number regions in the US and put a halt to that. And as a consequence Somero announced a profit warning that dropped their share price by around 20%.

Somero is clearly a cyclical business, not the sort of defensive investment I would prefer, so I've only taken a small position - effectively recycling cash from the sale of Manx Telecom last month. If you take a look at Somero's results during the financial crisis around 2008/9 they followed the economy rapidly downwards. If the US economy starts to decelerate, or the Trumpy trade nonsense dramatically reduces business capital expenditure, I would expect Somero to suffer. My hope is that the weather impact to the business is an exceptional episode in an otherwise great business, so I jumped on the chance to get a sliver of the business at a discount.

Portfolio

The portfolio followed the wider markets and bounced back up this month, not with quite the same vigour but I'm pleased with it. The portfolio was up 3.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 3.7% over the same period.

June prefect award goes to 888 (888), +24% following a positive trading update and a capital markets event that seemed to keep investors and analysts happy.

The dunce hat this month is with Fulcrum Utilities (FCRM), -15% due to a set of preliminary results that were delayed until July, due to some tricky sums. Unsurprisingly investors didn't react well.

June share purchase: SOM

Somero Enterprises (SOM) sell equipment to help make sure that when you're laying a concrete floor, that it's level. Really level. They are a US based business, with their HQ in Florida, and they make 69% of their money in the US. Despite this they are listed on the London AIM with a market cap around £160m.

They have been in business since 1986 and listed on the LSE in 2006. They have a great set of operating numbers, including over the last 5 years, ROCE averaging over 30%, net margins averaging over 20%, and zero debt. At the start of the year they reported a record order book, and things were looking very rosy, then severe rain hit a number regions in the US and put a halt to that. And as a consequence Somero announced a profit warning that dropped their share price by around 20%.

Somero is clearly a cyclical business, not the sort of defensive investment I would prefer, so I've only taken a small position - effectively recycling cash from the sale of Manx Telecom last month. If you take a look at Somero's results during the financial crisis around 2008/9 they followed the economy rapidly downwards. If the US economy starts to decelerate, or the Trumpy trade nonsense dramatically reduces business capital expenditure, I would expect Somero to suffer. My hope is that the weather impact to the business is an exceptional episode in an otherwise great business, so I jumped on the chance to get a sliver of the business at a discount.

Monday 17 June 2019

Index fun (ds)

On a rainy afternoon I decided to learn a bit more about Index funds, partly to understand if they should play more of a role in my investing. I don't have any money invested in them currently, and wondered if I should simply consider them as a ready made portfolio...as usual it ended up needing a few diversions in order to satisfy my curiosity...

What is the stock market?

Obtaining a listing on a stock exchange essentially enables a business access to capital, and would also potentially raise their profile through a public listing. They start life on the stock market through an IPO - an Initial Public Offering or stock market launch during which investors can buy shares in the business. The London Stock Exchange runs several markets on which a company can be listed - the two most of us are interested in are the Main Market and the Alternative Investment Market (AIM). The AIM has a simpler admission process and lower fees so is typically used by smaller and early stage businesses, but some of the AIM constituents are household names and have a market capitalisation comparable to some businesses in the FTSE 100, e.g. Burford Capital, Abcam, ASOS and Fevertree.

The London Stock Exchange (LSE) is managed by the helpfully named London Stock Exchange Group - which is also a publicly traded company listed on the LSE. According to the LSE there are over 2600 listed on the Main Market, from over 60 countries, plus another 1000+ listings on the AIM. The LSE enables stocks to be traded, and publishes price information on it's stocks every 15 seconds during trading hours.

What is an index?

Indices are slices of the stock market, with some sort of overarching logic driving what is included in that particular slice. They are often used to measure performance of that particular collection of stocks, against which the performance of other funds and/or portfolios can be assessed. A few such indices are:

What is the stock market?

Obtaining a listing on a stock exchange essentially enables a business access to capital, and would also potentially raise their profile through a public listing. They start life on the stock market through an IPO - an Initial Public Offering or stock market launch during which investors can buy shares in the business. The London Stock Exchange runs several markets on which a company can be listed - the two most of us are interested in are the Main Market and the Alternative Investment Market (AIM). The AIM has a simpler admission process and lower fees so is typically used by smaller and early stage businesses, but some of the AIM constituents are household names and have a market capitalisation comparable to some businesses in the FTSE 100, e.g. Burford Capital, Abcam, ASOS and Fevertree.

The London Stock Exchange (LSE) is managed by the helpfully named London Stock Exchange Group - which is also a publicly traded company listed on the LSE. According to the LSE there are over 2600 listed on the Main Market, from over 60 countries, plus another 1000+ listings on the AIM. The LSE enables stocks to be traded, and publishes price information on it's stocks every 15 seconds during trading hours.

What is an index?

Indices are slices of the stock market, with some sort of overarching logic driving what is included in that particular slice. They are often used to measure performance of that particular collection of stocks, against which the performance of other funds and/or portfolios can be assessed. A few such indices are:

- The MSCI world is an index using the share price of over 1600 business across the globe

- The S&P 500 is an index of 500 of the largest market capitalisation companies listed on 3 US stock exchanges

- The FTSE 100 is an index of the 100 largest market capitalisation companies listed on the London Stock Exchange

There are more indices than you can shake a stick at, against which you can measure the performance of your portfolio.

Index funds

So, getting finally to the starting point, Index funds...most major investment providers have funds which track an index into which you can invest e.g. ishares or vanguard. An index tracker fund will be composed to mimic the index via a couple of methodologies - either directly holding the shares in exactly the weighting as the index, or taking a sample of these shares in order to reflect the same underlying performance of the index.

The index as a portfolio

The index I'll focus on, mainly due to familiarity and convenience is the FTSE 100, which is maintained by FTSE Russell, part of the London Stock Exchange Group. This is an index composed of the 100 shares listed on the LSE with the largest market capitalisation (market cap = number of shares x share price). Shell have two flavours of their shares, both of which are listed in the FTSE 100, so there are 100 companies making up the FTSE 100, but 101 different stocks listed.

The FTSE 100 isn't a portfolio that is static, it is reviewed and, potentially, changed quarterly. The review process is described here. Each quarter, at the time of the review, any shares not currently in the FTSE 100, that have a market cap that puts them in the 90th position in the FTSE 100, or above, gets included in the index, and the shares with the lowest market cap are removed from the index. And any shares in the FTSE 100 that are valued at the 111th position in the wider FTSE All Share or below are removed from the FTSE 100, and are replaced by the shares outside the FTSE 100 with the largest market cap. For example as at June 2019, Hikma Pharmaceuticals and Easyjet hit the conditions for removal, whereas JD Sports and Aveva met the conditions for inclusion, a nice summary of this can be seen here.

Working on the assumption that share price performance more or less reflects the underlying performance of the business, we can see struggling business being cut from the portfolio, and high performing businesses being included. In the month of June 2019, we see two companies being promoted that are embracing technology, one a software company, the other a clothes retailer with a great ecommerce offering. From a portfolio management point of view this feels very much like cutting losers, and keeping winners. Since the Index does this rebalancing every quarter, so too do the funds tracking them.

Portfolio composition

My personal portfolio composition can be seen here. My aim is to mainly invest in defensive dividend paying stocks. How does the FTSE 100 measure up in this regard, there is plenty of information on the index here, I've taken the chart below from the Vanguard FTSE 100 tracking fund :

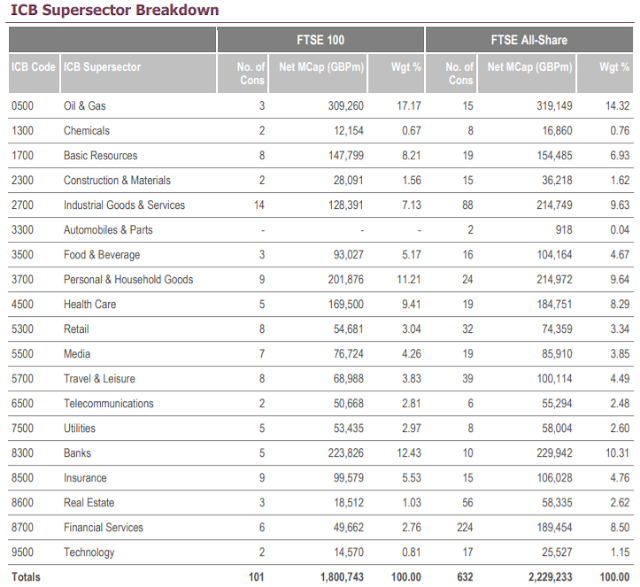

And below is a comparison from FTSE Russell between the FTSE 100 and the FTSE All Share:

Taking the Vanguard summary stats, it is clear there is a good chunk of the FTSE 100 portfolio that is very cyclical - Financials, Oil & Gas, Basic Materials and Industrials. These amount to around 56% of the FTSE 100. Add in another 3% for Utilities exposed to a potential risk of nationalisation (or at least being used as a political football in the UK), and there is getting on for 60% of the index that I would prefer to not be invested in. Which is not to say I wouldn't invest, but have a preference to put my money into less cyclical businesses, that offer some distinct competitive advantage other than price.

In addition it's difficult to see where the growth is going to be generated. We've seen from the US and China how technology is driving their stock markets, there is precious little of this in the FTSE 100. I'm sure these companies will eventually float to the top, assuming they are not acquired and absorbed into other business before they get there; as at June 2019, Microfocus and Sage are the two "technology" companies. This compares to technology making up around 21% of the S&P 500.

So, does it matter how the FTSE 100 is composed? Well, for example, since BP and Shell account for around 17% the oil price is going to push around the index valuation considerably. If some headline hits the banking industry - that's 12% of the index. At the other end of the index, if Sage had a significant increase in price it would make little difference to the index as both they, and Microfocus, combined make up less than 1% of the index.

Although the FTSE 100 is a slice of the stock market of businesses listed in London, as the LSE Issuer Services report shows, only about 29% of the revenues of the 100 listed businesses are actually from the UK. So there is an inherent currency risk too - stocks list on the LSE in Sterling, so revenues taken outside the UK need to eventually be reflected in a GBP stock price. This has probably proved something of a boon for a number of companies over the last few years as the Brexit omnishambles has kept Sterling depressed vs. both the Euro and the Dollar.

The bottom line

The FTSE 100 closed at 6754 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 7345, an 8.8% increase. It's Price to Earnings ratio is around 14, so may be on the cheap side with potentially more upwards movement on the way, and the dividend yield on the Vanguard tracker mentioned above is 4.76%, which might also reinforce the idea that the FTSE 100 currently looks a bit undervalued.

The S&P 500 closed at 1962 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 2886, a 47% increase. It's PE is around 19, and the dividend is 1.67%. Maybe the index is expensive, with little scope for upwards movement.

The FTSE 100 is not structured in a way I find especially attractive, too heavily focussed on cyclical businesses, particularly commodities and financials. However, although the dividend yield is attractive, I think there are individual businesses within it that look more attractive investments.

So, getting finally to the starting point, Index funds...most major investment providers have funds which track an index into which you can invest e.g. ishares or vanguard. An index tracker fund will be composed to mimic the index via a couple of methodologies - either directly holding the shares in exactly the weighting as the index, or taking a sample of these shares in order to reflect the same underlying performance of the index.

The index as a portfolio

The index I'll focus on, mainly due to familiarity and convenience is the FTSE 100, which is maintained by FTSE Russell, part of the London Stock Exchange Group. This is an index composed of the 100 shares listed on the LSE with the largest market capitalisation (market cap = number of shares x share price). Shell have two flavours of their shares, both of which are listed in the FTSE 100, so there are 100 companies making up the FTSE 100, but 101 different stocks listed.

The FTSE 100 isn't a portfolio that is static, it is reviewed and, potentially, changed quarterly. The review process is described here. Each quarter, at the time of the review, any shares not currently in the FTSE 100, that have a market cap that puts them in the 90th position in the FTSE 100, or above, gets included in the index, and the shares with the lowest market cap are removed from the index. And any shares in the FTSE 100 that are valued at the 111th position in the wider FTSE All Share or below are removed from the FTSE 100, and are replaced by the shares outside the FTSE 100 with the largest market cap. For example as at June 2019, Hikma Pharmaceuticals and Easyjet hit the conditions for removal, whereas JD Sports and Aveva met the conditions for inclusion, a nice summary of this can be seen here.

Working on the assumption that share price performance more or less reflects the underlying performance of the business, we can see struggling business being cut from the portfolio, and high performing businesses being included. In the month of June 2019, we see two companies being promoted that are embracing technology, one a software company, the other a clothes retailer with a great ecommerce offering. From a portfolio management point of view this feels very much like cutting losers, and keeping winners. Since the Index does this rebalancing every quarter, so too do the funds tracking them.

Portfolio composition

My personal portfolio composition can be seen here. My aim is to mainly invest in defensive dividend paying stocks. How does the FTSE 100 measure up in this regard, there is plenty of information on the index here, I've taken the chart below from the Vanguard FTSE 100 tracking fund :

|

| Vanguard FTSE 100 UCITS ETF Sector Composition (May 31 2019) |

|

| FTSE Russell index comparisons |

In addition it's difficult to see where the growth is going to be generated. We've seen from the US and China how technology is driving their stock markets, there is precious little of this in the FTSE 100. I'm sure these companies will eventually float to the top, assuming they are not acquired and absorbed into other business before they get there; as at June 2019, Microfocus and Sage are the two "technology" companies. This compares to technology making up around 21% of the S&P 500.

So, does it matter how the FTSE 100 is composed? Well, for example, since BP and Shell account for around 17% the oil price is going to push around the index valuation considerably. If some headline hits the banking industry - that's 12% of the index. At the other end of the index, if Sage had a significant increase in price it would make little difference to the index as both they, and Microfocus, combined make up less than 1% of the index.

Although the FTSE 100 is a slice of the stock market of businesses listed in London, as the LSE Issuer Services report shows, only about 29% of the revenues of the 100 listed businesses are actually from the UK. So there is an inherent currency risk too - stocks list on the LSE in Sterling, so revenues taken outside the UK need to eventually be reflected in a GBP stock price. This has probably proved something of a boon for a number of companies over the last few years as the Brexit omnishambles has kept Sterling depressed vs. both the Euro and the Dollar.

The bottom line

The FTSE 100 closed at 6754 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 7345, an 8.8% increase. It's Price to Earnings ratio is around 14, so may be on the cheap side with potentially more upwards movement on the way, and the dividend yield on the Vanguard tracker mentioned above is 4.76%, which might also reinforce the idea that the FTSE 100 currently looks a bit undervalued.

The S&P 500 closed at 1962 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 2886, a 47% increase. It's PE is around 19, and the dividend is 1.67%. Maybe the index is expensive, with little scope for upwards movement.

The FTSE 100 is not structured in a way I find especially attractive, too heavily focussed on cyclical businesses, particularly commodities and financials. However, although the dividend yield is attractive, I think there are individual businesses within it that look more attractive investments.

Saturday 1 June 2019

May 2019 portfolio update

Most of May was dominated by Trumpy being particularly bonkers. Then came the latest chapter in the Brexit omnishambles, and the PM resigning. All of which resulted in a degree of turbulence in the markets. In a way this is appreciated since I'm looking to buy rather than sell, so lower prices are welcomed and most of what's on my shopping list looks expensive. There are a couple of things in foreign markets that I'd like to buy as their prices are more attractive, however the state of sterling counteracts the lower stock prices in my view. The combination of high prices and turbulence left me sitting on my hands this month in anticipation of more sensible prices over the coming weeks as the prospect of a new broom at no. 10, more Brexit, and Trump's twitter account disturb the markets.

Portfolio

A few wobbles in the markets this month. The portfolio just kept it's head above water, being up 0.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was off by -3% over the same period.

Top banana in May was Abcam (ABC), managing a 9% increase over the month.

The laggard for the second month in a row, was Saga (SAGA) dropping -28%. I'm not too concerned as it was a small punt taken on a turnaround...it's got to turn quite a way now though...Note to self, silly boy, make sure you've got a stop loss in place if dabbling in future.

The acquisition of Manx Telecom by Basalt Infrastructure was finalised over the month, so that's now out of the portfolio, departing with a 32% gain. Proceeds of the sale is added to the cash pot along with dividends, which pleasingly have accumulated to enable a purchase funded entirely from profits and dividends.

Bitcoin chugged upwards over the month, and seems to have settled above $8k. Hopefully volumes will stay up and the market manipulators will find life more difficult as a result. Alt coins are starting to enjoy themselves and I'm looking forward to a bit more green across the crypto portfolio over the summer. Traded out of a few altcoins and will be moving more into BTC when the prices are right - overall pretty much at breakeven after a few months in the red.

Portfolio

A few wobbles in the markets this month. The portfolio just kept it's head above water, being up 0.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was off by -3% over the same period.

Top banana in May was Abcam (ABC), managing a 9% increase over the month.

The laggard for the second month in a row, was Saga (SAGA) dropping -28%. I'm not too concerned as it was a small punt taken on a turnaround...it's got to turn quite a way now though...Note to self, silly boy, make sure you've got a stop loss in place if dabbling in future.

The acquisition of Manx Telecom by Basalt Infrastructure was finalised over the month, so that's now out of the portfolio, departing with a 32% gain. Proceeds of the sale is added to the cash pot along with dividends, which pleasingly have accumulated to enable a purchase funded entirely from profits and dividends.

Bitcoin chugged upwards over the month, and seems to have settled above $8k. Hopefully volumes will stay up and the market manipulators will find life more difficult as a result. Alt coins are starting to enjoy themselves and I'm looking forward to a bit more green across the crypto portfolio over the summer. Traded out of a few altcoins and will be moving more into BTC when the prices are right - overall pretty much at breakeven after a few months in the red.

Thursday 9 May 2019

Sell in May (or October)?

2018 Winter slide

From the start of October 2018 until the end of December 2018 the stock markets saw a pretty big sell off. Various concerns over the global economy, China, Trump, the Federal reserve, Brexit all combined with historically high valuations with some of the big tech companies to create a very delicate balancing act for the stock market. It couldn't last and the US stock market rolled over. On 3rd October the S&P 500 was at 2925, by 21st December it was at 2351 a 20% drop. In the UK the FTSE 100 had been under pressure since May 2018 and had been losing ground over 6 months, but followed the S&P lower during the winter, losing 12% from 7510 on 3rd October to a low of 6584 on 27th December.

This was followed by a new year rally that saw the S&P rise 25% from December and the FTSE 12%.

I remember reading and listening to various pundits remarking on the need to sell stocks and move into cash. I didn't, and was wondering what would have happened had I done so. If I had managed to catch that wave would I now be looking at my portfolio that was 12% higher?

I'll take a retrospective look at this using the 3 biggest holdings in my portfolio - Unilever, GlaxoSmithKline and Compass.

Wind back the clock - Unilever

Unilever put in a lot of effort to shoot themselves in the foot in 2018. They have a head office split between Holland and the UK and they had proposed to consolidate this into a single location in Holland. A knock on effect would have meant they would have to delist from the main UK indices, although they could still be traded in the UK, funds holding stocks listed on the main indices, index trackers etc. would have been forced to sell their Unilever shares. This proposal required approval by investors, and there was some disquiet and disagreement between investors, particularly large institutional investors who questioned the logic of the move, and company management. The share price had a bit of a wobble and was probably a little lower than it would otherwise have been as a result. On 3rd October 2018 it stood at 4224p, on 27th December when the FTSE 100 hit it's low point, the Unilever share price was 4080p, 3.5% lower. A month later on 28th January it was 3941p, 6.5% lower than October. It hit similar low points in the middle of October and the end of February. At what points would I have bought and sold?

I probably would have sold at some point in the first couple of weeks in October, as the pessimistic outlook from many commentators started to play out across the markets. I would probably have looked for a nice round number, maybe waiting for the price to reduce by 10%...but it never would have got that far. As noted above a "perfect" trade would have resulted in a 6.5% increase.

But I would have incurred commission on the purchase, plus tax, and if I had not held the stock on the ex-dividend date of 1st November, I would have missed the quarterly dividend payout too.

I could have got that 10% by selling at the end of August and buying back in at the bottom of one of the dips during the winter. Whilst the FTSE was sliding, and did so from around May to December, Unilever wasn't following suit. It see-sawed through the summer and autumn, and had a 2 month mini-rally all of it's own from mid-October to mid-December.

Wind back the clock - Compass

Compass seems to be a particularly pedestrian and uneventful investment, it just seems to plod slowly onwards. Perfect. However, it got a wriggle on during the autumn sell off, it was at 1709p on 2nd October, and dropped 13% to 1483p 20 days later. But if you'd been sluggish you would have missed it, as by the 21st November it was back to 1697p. After which it meandered until the end of January when it decided to wander upwards.

I could have grabbed a 10% bounce, and could have avoided ex-dividend cut offs, but I would have had to have been quick. I would also have been moving against all of the indicators that would have caused me to sell in the first place, as the FTSE continued to drop whilst Compass turned upwards.

Wind back the clock - GlaxoSmithKline

The GSK share price has been more volatile than either Unilever or Compass, and has looked less than nimble as it has tried to turn itself back into a business making a decent profit. The share price probably reflected a busy year during which GSK got a break from delays in competitors bringing generic versions of it's Advair product to market, offloaded Horlicks, got into bed with Pfizer, and started the process of splitting it's business into a couple of logical chunks.

During the market doom and gloom, on 3rd October, GSK stood at 1554p, had dropped to 1429p by the 12th October - an 8% wobble. But a week later, by the 19th October the price was back where it started. It's biggest move over the winter was a 12% drop from 1621p on the 30th November, to 1418p on the 6th December.

Like Unilever and Compass, GSK isn't neatly aligned to the wider FTSE movements during this sell off. There are clear periods of the price increasing and the index continues to sell off. As with Unilever, the quarterly dividends paid by GSK mean that there was an ex-dividend date during this sell off - 15th November, so jumping in and out of the stock might have required navigating that date too. But there were clearly periods when some cunning market timing would have been profitable.

Conclusion

There are some obvious opportunities to make some extra profit it I could time these jumps into and out stocks. And in answer to my earlier question about making an extra 12%, it was probably possible, at least for some of my holdings.

But it seems like terribly hard work to get it right. I think I'd rather be lazy, at least until I have more time on my hands to keep a beady eye on the markets. I enjoy reading about the economy and listening to pundits pronounce on the next amazing/ awful move from the markets, but it doesn't really excite me. I have a 20 year timeframe in mind for these investments, and whilst I intend to keep a watch on them, I shan't be doing so every day.

From the start of October 2018 until the end of December 2018 the stock markets saw a pretty big sell off. Various concerns over the global economy, China, Trump, the Federal reserve, Brexit all combined with historically high valuations with some of the big tech companies to create a very delicate balancing act for the stock market. It couldn't last and the US stock market rolled over. On 3rd October the S&P 500 was at 2925, by 21st December it was at 2351 a 20% drop. In the UK the FTSE 100 had been under pressure since May 2018 and had been losing ground over 6 months, but followed the S&P lower during the winter, losing 12% from 7510 on 3rd October to a low of 6584 on 27th December.

This was followed by a new year rally that saw the S&P rise 25% from December and the FTSE 12%.

I remember reading and listening to various pundits remarking on the need to sell stocks and move into cash. I didn't, and was wondering what would have happened had I done so. If I had managed to catch that wave would I now be looking at my portfolio that was 12% higher?

I'll take a retrospective look at this using the 3 biggest holdings in my portfolio - Unilever, GlaxoSmithKline and Compass.

Wind back the clock - Unilever

Unilever put in a lot of effort to shoot themselves in the foot in 2018. They have a head office split between Holland and the UK and they had proposed to consolidate this into a single location in Holland. A knock on effect would have meant they would have to delist from the main UK indices, although they could still be traded in the UK, funds holding stocks listed on the main indices, index trackers etc. would have been forced to sell their Unilever shares. This proposal required approval by investors, and there was some disquiet and disagreement between investors, particularly large institutional investors who questioned the logic of the move, and company management. The share price had a bit of a wobble and was probably a little lower than it would otherwise have been as a result. On 3rd October 2018 it stood at 4224p, on 27th December when the FTSE 100 hit it's low point, the Unilever share price was 4080p, 3.5% lower. A month later on 28th January it was 3941p, 6.5% lower than October. It hit similar low points in the middle of October and the end of February. At what points would I have bought and sold?

I probably would have sold at some point in the first couple of weeks in October, as the pessimistic outlook from many commentators started to play out across the markets. I would probably have looked for a nice round number, maybe waiting for the price to reduce by 10%...but it never would have got that far. As noted above a "perfect" trade would have resulted in a 6.5% increase.

But I would have incurred commission on the purchase, plus tax, and if I had not held the stock on the ex-dividend date of 1st November, I would have missed the quarterly dividend payout too.

I could have got that 10% by selling at the end of August and buying back in at the bottom of one of the dips during the winter. Whilst the FTSE was sliding, and did so from around May to December, Unilever wasn't following suit. It see-sawed through the summer and autumn, and had a 2 month mini-rally all of it's own from mid-October to mid-December.

Wind back the clock - Compass

Compass seems to be a particularly pedestrian and uneventful investment, it just seems to plod slowly onwards. Perfect. However, it got a wriggle on during the autumn sell off, it was at 1709p on 2nd October, and dropped 13% to 1483p 20 days later. But if you'd been sluggish you would have missed it, as by the 21st November it was back to 1697p. After which it meandered until the end of January when it decided to wander upwards.

I could have grabbed a 10% bounce, and could have avoided ex-dividend cut offs, but I would have had to have been quick. I would also have been moving against all of the indicators that would have caused me to sell in the first place, as the FTSE continued to drop whilst Compass turned upwards.

Wind back the clock - GlaxoSmithKline

The GSK share price has been more volatile than either Unilever or Compass, and has looked less than nimble as it has tried to turn itself back into a business making a decent profit. The share price probably reflected a busy year during which GSK got a break from delays in competitors bringing generic versions of it's Advair product to market, offloaded Horlicks, got into bed with Pfizer, and started the process of splitting it's business into a couple of logical chunks.

During the market doom and gloom, on 3rd October, GSK stood at 1554p, had dropped to 1429p by the 12th October - an 8% wobble. But a week later, by the 19th October the price was back where it started. It's biggest move over the winter was a 12% drop from 1621p on the 30th November, to 1418p on the 6th December.

Like Unilever and Compass, GSK isn't neatly aligned to the wider FTSE movements during this sell off. There are clear periods of the price increasing and the index continues to sell off. As with Unilever, the quarterly dividends paid by GSK mean that there was an ex-dividend date during this sell off - 15th November, so jumping in and out of the stock might have required navigating that date too. But there were clearly periods when some cunning market timing would have been profitable.

Conclusion

There are some obvious opportunities to make some extra profit it I could time these jumps into and out stocks. And in answer to my earlier question about making an extra 12%, it was probably possible, at least for some of my holdings.

But it seems like terribly hard work to get it right. I think I'd rather be lazy, at least until I have more time on my hands to keep a beady eye on the markets. I enjoy reading about the economy and listening to pundits pronounce on the next amazing/ awful move from the markets, but it doesn't really excite me. I have a 20 year timeframe in mind for these investments, and whilst I intend to keep a watch on them, I shan't be doing so every day.

Wednesday 1 May 2019

April Portfolio and Purchases

After a slight hiatus during March, life was back to normal in April. The March pause meant I had some budget carrying over into April so 2 additions this month.

Portfolio

April once again had markets chugging upwards. The portfolio was up 1.4% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 2.7% over the same period.

April top dog was Computacenter (CCC), +9% following a positive trading update at the end of the month.

Bringing up the rear, sick as a dog Saga (SAGA) dropped -47%. Thankfully this was a small punt taken last year - now considerably smaller. Unfortunately several very positive results last year from similar contrarian picks led me down this dubious route. The results from the company gave the impression the management have been asleep at the wheel, and I have no confidence in any turnaround. I'll hang on for a couple of months as the markets usually get carried away particularly on bad news, so I might see a slight bounce, but I'll sell and recycle the money into something more sensible in the near future.

April share purchase 1: ABC

Abcam (ABC) sell research tools and products for academic pharmaceutical and biotech labs. They are listed on the AIM but they are no tiddler, they are one the larger companies on the AIM with a market capitalisation around £2.5bn which puts them alongside household names such as Britvic or the Royal Mail (in market cap terms at least). They have been in business since 1998, and have grown up selling research grade antibodies to laboratories around the globe, and now sell a range of biological products and testing toolkits. If you fancy purchasing yourself a few antibodies, you can fill your boots here.

They have a very solid set of financial results including ROCE averaging in the high teens over the last 10yrs, great margins and no debt. My preference is for defensively placed companies that are likely to deliver solid returns no matter what economic conditions prevail. I am also looking for companies embracing technology, that are likely to be driving progress in their fields rather than following others, and preferably those establishing some kind of dominance within their markets. Abcam ticks a lot of these boxes.

April share purchase 2: RB.

To the FTSE100 for purchase number 2 in April - Reckitt Benckiser. News about Indivior's run in with the US Department of Justice led to some nervousness about collateral damage to prior parent company Reckitt Benckiser (RB). Indivior was Reckitt Benckiser Pharmaceuticals in a previous life, but was spun out of the parent company in 2014. RB insist any wrongdoing happened after the demerger, and have made a provision of £313m to cover any liabilities (see note 19 in the 2018 annual report). As a result the RB price dipped by over 9% over the course of a few days following the Indivior news. I like the look of RB, as I wrote here, with the exception of the debt it took on to fund the Mead Johnson purchase, they have a very respectable set of numbers. Plus they are exactly the sort of defensive business that I would prefer to invest in, and should be comfortable cuddling up next to Unilever in the portfolio.

Portfolio

April once again had markets chugging upwards. The portfolio was up 1.4% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 2.7% over the same period.

April top dog was Computacenter (CCC), +9% following a positive trading update at the end of the month.

Bringing up the rear, sick as a dog Saga (SAGA) dropped -47%. Thankfully this was a small punt taken last year - now considerably smaller. Unfortunately several very positive results last year from similar contrarian picks led me down this dubious route. The results from the company gave the impression the management have been asleep at the wheel, and I have no confidence in any turnaround. I'll hang on for a couple of months as the markets usually get carried away particularly on bad news, so I might see a slight bounce, but I'll sell and recycle the money into something more sensible in the near future.

April share purchase 1: ABC

Abcam (ABC) sell research tools and products for academic pharmaceutical and biotech labs. They are listed on the AIM but they are no tiddler, they are one the larger companies on the AIM with a market capitalisation around £2.5bn which puts them alongside household names such as Britvic or the Royal Mail (in market cap terms at least). They have been in business since 1998, and have grown up selling research grade antibodies to laboratories around the globe, and now sell a range of biological products and testing toolkits. If you fancy purchasing yourself a few antibodies, you can fill your boots here.

They have a very solid set of financial results including ROCE averaging in the high teens over the last 10yrs, great margins and no debt. My preference is for defensively placed companies that are likely to deliver solid returns no matter what economic conditions prevail. I am also looking for companies embracing technology, that are likely to be driving progress in their fields rather than following others, and preferably those establishing some kind of dominance within their markets. Abcam ticks a lot of these boxes.

April share purchase 2: RB.