June saw a recovery after the May mini-selloff, a shame in a way as a few things on the shopping list were starting to have attractive prices. Unfortunately I was a bit sluggish, other people noticed and they started getting bought again. As a result I have quite a bit of dry powder to deploy, I'm sure the crazy gang of Trump, Johnson and Hunt will help the markets move back into buying territory before long.

Portfolio

The portfolio followed the wider markets and bounced back up this month, not with quite the same vigour but I'm pleased with it. The portfolio was up 3.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 3.7% over the same period.

June prefect award goes to 888 (888), +24% following a positive trading update and a capital markets event that seemed to keep investors and analysts happy.

The dunce hat this month is with Fulcrum Utilities (FCRM), -15% due to a set of preliminary results that were delayed until July, due to some tricky sums. Unsurprisingly investors didn't react well.

June share purchase: SOM

Somero Enterprises (SOM) sell equipment to help make sure that when you're laying a concrete floor, that it's level. Really level. They are a US based business, with their HQ in Florida, and they make 69% of their money in the US. Despite this they are listed on the London AIM with a market cap around £160m.

They have been in business since 1986 and listed on the LSE in 2006. They have a great set of operating numbers, including over the last 5 years, ROCE averaging over 30%, net margins averaging over 20%, and zero debt. At the start of the year they reported a record order book, and things were looking very rosy, then severe rain hit a number regions in the US and put a halt to that. And as a consequence Somero announced a profit warning that dropped their share price by around 20%.

Somero is clearly a cyclical business, not the sort of defensive investment I would prefer, so I've only taken a small position - effectively recycling cash from the sale of Manx Telecom last month. If you take a look at Somero's results during the financial crisis around 2008/9 they followed the economy rapidly downwards. If the US economy starts to decelerate, or the Trumpy trade nonsense dramatically reduces business capital expenditure, I would expect Somero to suffer. My hope is that the weather impact to the business is an exceptional episode in an otherwise great business, so I jumped on the chance to get a sliver of the business at a discount.

Friday, 28 June 2019

Monday, 17 June 2019

Index fun (ds)

On a rainy afternoon I decided to learn a bit more about Index funds, partly to understand if they should play more of a role in my investing. I don't have any money invested in them currently, and wondered if I should simply consider them as a ready made portfolio...as usual it ended up needing a few diversions in order to satisfy my curiosity...

What is the stock market?

Obtaining a listing on a stock exchange essentially enables a business access to capital, and would also potentially raise their profile through a public listing. They start life on the stock market through an IPO - an Initial Public Offering or stock market launch during which investors can buy shares in the business. The London Stock Exchange runs several markets on which a company can be listed - the two most of us are interested in are the Main Market and the Alternative Investment Market (AIM). The AIM has a simpler admission process and lower fees so is typically used by smaller and early stage businesses, but some of the AIM constituents are household names and have a market capitalisation comparable to some businesses in the FTSE 100, e.g. Burford Capital, Abcam, ASOS and Fevertree.

The London Stock Exchange (LSE) is managed by the helpfully named London Stock Exchange Group - which is also a publicly traded company listed on the LSE. According to the LSE there are over 2600 listed on the Main Market, from over 60 countries, plus another 1000+ listings on the AIM. The LSE enables stocks to be traded, and publishes price information on it's stocks every 15 seconds during trading hours.

What is an index?

Indices are slices of the stock market, with some sort of overarching logic driving what is included in that particular slice. They are often used to measure performance of that particular collection of stocks, against which the performance of other funds and/or portfolios can be assessed. A few such indices are:

What is the stock market?

Obtaining a listing on a stock exchange essentially enables a business access to capital, and would also potentially raise their profile through a public listing. They start life on the stock market through an IPO - an Initial Public Offering or stock market launch during which investors can buy shares in the business. The London Stock Exchange runs several markets on which a company can be listed - the two most of us are interested in are the Main Market and the Alternative Investment Market (AIM). The AIM has a simpler admission process and lower fees so is typically used by smaller and early stage businesses, but some of the AIM constituents are household names and have a market capitalisation comparable to some businesses in the FTSE 100, e.g. Burford Capital, Abcam, ASOS and Fevertree.

The London Stock Exchange (LSE) is managed by the helpfully named London Stock Exchange Group - which is also a publicly traded company listed on the LSE. According to the LSE there are over 2600 listed on the Main Market, from over 60 countries, plus another 1000+ listings on the AIM. The LSE enables stocks to be traded, and publishes price information on it's stocks every 15 seconds during trading hours.

What is an index?

Indices are slices of the stock market, with some sort of overarching logic driving what is included in that particular slice. They are often used to measure performance of that particular collection of stocks, against which the performance of other funds and/or portfolios can be assessed. A few such indices are:

- The MSCI world is an index using the share price of over 1600 business across the globe

- The S&P 500 is an index of 500 of the largest market capitalisation companies listed on 3 US stock exchanges

- The FTSE 100 is an index of the 100 largest market capitalisation companies listed on the London Stock Exchange

There are more indices than you can shake a stick at, against which you can measure the performance of your portfolio.

Index funds

So, getting finally to the starting point, Index funds...most major investment providers have funds which track an index into which you can invest e.g. ishares or vanguard. An index tracker fund will be composed to mimic the index via a couple of methodologies - either directly holding the shares in exactly the weighting as the index, or taking a sample of these shares in order to reflect the same underlying performance of the index.

The index as a portfolio

The index I'll focus on, mainly due to familiarity and convenience is the FTSE 100, which is maintained by FTSE Russell, part of the London Stock Exchange Group. This is an index composed of the 100 shares listed on the LSE with the largest market capitalisation (market cap = number of shares x share price). Shell have two flavours of their shares, both of which are listed in the FTSE 100, so there are 100 companies making up the FTSE 100, but 101 different stocks listed.

The FTSE 100 isn't a portfolio that is static, it is reviewed and, potentially, changed quarterly. The review process is described here. Each quarter, at the time of the review, any shares not currently in the FTSE 100, that have a market cap that puts them in the 90th position in the FTSE 100, or above, gets included in the index, and the shares with the lowest market cap are removed from the index. And any shares in the FTSE 100 that are valued at the 111th position in the wider FTSE All Share or below are removed from the FTSE 100, and are replaced by the shares outside the FTSE 100 with the largest market cap. For example as at June 2019, Hikma Pharmaceuticals and Easyjet hit the conditions for removal, whereas JD Sports and Aveva met the conditions for inclusion, a nice summary of this can be seen here.

Working on the assumption that share price performance more or less reflects the underlying performance of the business, we can see struggling business being cut from the portfolio, and high performing businesses being included. In the month of June 2019, we see two companies being promoted that are embracing technology, one a software company, the other a clothes retailer with a great ecommerce offering. From a portfolio management point of view this feels very much like cutting losers, and keeping winners. Since the Index does this rebalancing every quarter, so too do the funds tracking them.

Portfolio composition

My personal portfolio composition can be seen here. My aim is to mainly invest in defensive dividend paying stocks. How does the FTSE 100 measure up in this regard, there is plenty of information on the index here, I've taken the chart below from the Vanguard FTSE 100 tracking fund :

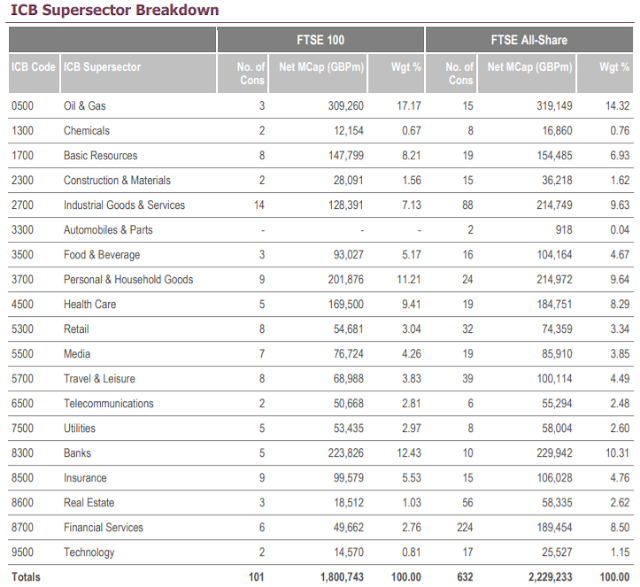

And below is a comparison from FTSE Russell between the FTSE 100 and the FTSE All Share:

Taking the Vanguard summary stats, it is clear there is a good chunk of the FTSE 100 portfolio that is very cyclical - Financials, Oil & Gas, Basic Materials and Industrials. These amount to around 56% of the FTSE 100. Add in another 3% for Utilities exposed to a potential risk of nationalisation (or at least being used as a political football in the UK), and there is getting on for 60% of the index that I would prefer to not be invested in. Which is not to say I wouldn't invest, but have a preference to put my money into less cyclical businesses, that offer some distinct competitive advantage other than price.

In addition it's difficult to see where the growth is going to be generated. We've seen from the US and China how technology is driving their stock markets, there is precious little of this in the FTSE 100. I'm sure these companies will eventually float to the top, assuming they are not acquired and absorbed into other business before they get there; as at June 2019, Microfocus and Sage are the two "technology" companies. This compares to technology making up around 21% of the S&P 500.

So, does it matter how the FTSE 100 is composed? Well, for example, since BP and Shell account for around 17% the oil price is going to push around the index valuation considerably. If some headline hits the banking industry - that's 12% of the index. At the other end of the index, if Sage had a significant increase in price it would make little difference to the index as both they, and Microfocus, combined make up less than 1% of the index.

Although the FTSE 100 is a slice of the stock market of businesses listed in London, as the LSE Issuer Services report shows, only about 29% of the revenues of the 100 listed businesses are actually from the UK. So there is an inherent currency risk too - stocks list on the LSE in Sterling, so revenues taken outside the UK need to eventually be reflected in a GBP stock price. This has probably proved something of a boon for a number of companies over the last few years as the Brexit omnishambles has kept Sterling depressed vs. both the Euro and the Dollar.

The bottom line

The FTSE 100 closed at 6754 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 7345, an 8.8% increase. It's Price to Earnings ratio is around 14, so may be on the cheap side with potentially more upwards movement on the way, and the dividend yield on the Vanguard tracker mentioned above is 4.76%, which might also reinforce the idea that the FTSE 100 currently looks a bit undervalued.

The S&P 500 closed at 1962 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 2886, a 47% increase. It's PE is around 19, and the dividend is 1.67%. Maybe the index is expensive, with little scope for upwards movement.

The FTSE 100 is not structured in a way I find especially attractive, too heavily focussed on cyclical businesses, particularly commodities and financials. However, although the dividend yield is attractive, I think there are individual businesses within it that look more attractive investments.

So, getting finally to the starting point, Index funds...most major investment providers have funds which track an index into which you can invest e.g. ishares or vanguard. An index tracker fund will be composed to mimic the index via a couple of methodologies - either directly holding the shares in exactly the weighting as the index, or taking a sample of these shares in order to reflect the same underlying performance of the index.

The index as a portfolio

The index I'll focus on, mainly due to familiarity and convenience is the FTSE 100, which is maintained by FTSE Russell, part of the London Stock Exchange Group. This is an index composed of the 100 shares listed on the LSE with the largest market capitalisation (market cap = number of shares x share price). Shell have two flavours of their shares, both of which are listed in the FTSE 100, so there are 100 companies making up the FTSE 100, but 101 different stocks listed.

The FTSE 100 isn't a portfolio that is static, it is reviewed and, potentially, changed quarterly. The review process is described here. Each quarter, at the time of the review, any shares not currently in the FTSE 100, that have a market cap that puts them in the 90th position in the FTSE 100, or above, gets included in the index, and the shares with the lowest market cap are removed from the index. And any shares in the FTSE 100 that are valued at the 111th position in the wider FTSE All Share or below are removed from the FTSE 100, and are replaced by the shares outside the FTSE 100 with the largest market cap. For example as at June 2019, Hikma Pharmaceuticals and Easyjet hit the conditions for removal, whereas JD Sports and Aveva met the conditions for inclusion, a nice summary of this can be seen here.

Working on the assumption that share price performance more or less reflects the underlying performance of the business, we can see struggling business being cut from the portfolio, and high performing businesses being included. In the month of June 2019, we see two companies being promoted that are embracing technology, one a software company, the other a clothes retailer with a great ecommerce offering. From a portfolio management point of view this feels very much like cutting losers, and keeping winners. Since the Index does this rebalancing every quarter, so too do the funds tracking them.

Portfolio composition

My personal portfolio composition can be seen here. My aim is to mainly invest in defensive dividend paying stocks. How does the FTSE 100 measure up in this regard, there is plenty of information on the index here, I've taken the chart below from the Vanguard FTSE 100 tracking fund :

|

| Vanguard FTSE 100 UCITS ETF Sector Composition (May 31 2019) |

|

| FTSE Russell index comparisons |

In addition it's difficult to see where the growth is going to be generated. We've seen from the US and China how technology is driving their stock markets, there is precious little of this in the FTSE 100. I'm sure these companies will eventually float to the top, assuming they are not acquired and absorbed into other business before they get there; as at June 2019, Microfocus and Sage are the two "technology" companies. This compares to technology making up around 21% of the S&P 500.

So, does it matter how the FTSE 100 is composed? Well, for example, since BP and Shell account for around 17% the oil price is going to push around the index valuation considerably. If some headline hits the banking industry - that's 12% of the index. At the other end of the index, if Sage had a significant increase in price it would make little difference to the index as both they, and Microfocus, combined make up less than 1% of the index.

Although the FTSE 100 is a slice of the stock market of businesses listed in London, as the LSE Issuer Services report shows, only about 29% of the revenues of the 100 listed businesses are actually from the UK. So there is an inherent currency risk too - stocks list on the LSE in Sterling, so revenues taken outside the UK need to eventually be reflected in a GBP stock price. This has probably proved something of a boon for a number of companies over the last few years as the Brexit omnishambles has kept Sterling depressed vs. both the Euro and the Dollar.

The bottom line

The FTSE 100 closed at 6754 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 7345, an 8.8% increase. It's Price to Earnings ratio is around 14, so may be on the cheap side with potentially more upwards movement on the way, and the dividend yield on the Vanguard tracker mentioned above is 4.76%, which might also reinforce the idea that the FTSE 100 currently looks a bit undervalued.

The S&P 500 closed at 1962 on June 16th 2014. 5yrs later on June 16th 2019 it closed trading at 2886, a 47% increase. It's PE is around 19, and the dividend is 1.67%. Maybe the index is expensive, with little scope for upwards movement.

The FTSE 100 is not structured in a way I find especially attractive, too heavily focussed on cyclical businesses, particularly commodities and financials. However, although the dividend yield is attractive, I think there are individual businesses within it that look more attractive investments.

Saturday, 1 June 2019

May 2019 portfolio update

Most of May was dominated by Trumpy being particularly bonkers. Then came the latest chapter in the Brexit omnishambles, and the PM resigning. All of which resulted in a degree of turbulence in the markets. In a way this is appreciated since I'm looking to buy rather than sell, so lower prices are welcomed and most of what's on my shopping list looks expensive. There are a couple of things in foreign markets that I'd like to buy as their prices are more attractive, however the state of sterling counteracts the lower stock prices in my view. The combination of high prices and turbulence left me sitting on my hands this month in anticipation of more sensible prices over the coming weeks as the prospect of a new broom at no. 10, more Brexit, and Trump's twitter account disturb the markets.

Portfolio

A few wobbles in the markets this month. The portfolio just kept it's head above water, being up 0.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was off by -3% over the same period.

Top banana in May was Abcam (ABC), managing a 9% increase over the month.

The laggard for the second month in a row, was Saga (SAGA) dropping -28%. I'm not too concerned as it was a small punt taken on a turnaround...it's got to turn quite a way now though...Note to self, silly boy, make sure you've got a stop loss in place if dabbling in future.

The acquisition of Manx Telecom by Basalt Infrastructure was finalised over the month, so that's now out of the portfolio, departing with a 32% gain. Proceeds of the sale is added to the cash pot along with dividends, which pleasingly have accumulated to enable a purchase funded entirely from profits and dividends.

Bitcoin chugged upwards over the month, and seems to have settled above $8k. Hopefully volumes will stay up and the market manipulators will find life more difficult as a result. Alt coins are starting to enjoy themselves and I'm looking forward to a bit more green across the crypto portfolio over the summer. Traded out of a few altcoins and will be moving more into BTC when the prices are right - overall pretty much at breakeven after a few months in the red.

Portfolio

A few wobbles in the markets this month. The portfolio just kept it's head above water, being up 0.2% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was off by -3% over the same period.

Top banana in May was Abcam (ABC), managing a 9% increase over the month.

The laggard for the second month in a row, was Saga (SAGA) dropping -28%. I'm not too concerned as it was a small punt taken on a turnaround...it's got to turn quite a way now though...Note to self, silly boy, make sure you've got a stop loss in place if dabbling in future.

The acquisition of Manx Telecom by Basalt Infrastructure was finalised over the month, so that's now out of the portfolio, departing with a 32% gain. Proceeds of the sale is added to the cash pot along with dividends, which pleasingly have accumulated to enable a purchase funded entirely from profits and dividends.

Bitcoin chugged upwards over the month, and seems to have settled above $8k. Hopefully volumes will stay up and the market manipulators will find life more difficult as a result. Alt coins are starting to enjoy themselves and I'm looking forward to a bit more green across the crypto portfolio over the summer. Traded out of a few altcoins and will be moving more into BTC when the prices are right - overall pretty much at breakeven after a few months in the red.

Subscribe to:

Comments (Atom)