Slight pause on most things during March due to family illness, and wrecking my back. Now more or less back to normal...

So Brexit drags on into April with no more clarity as to what is going on. This, coupled with prices generally trending upwards left me mostly on the sidelines spectating during March. A few things are in buying territory, but most of what is on the shopping list still looks expensive.

Portfolio

March saw markets continuing the upward movement we've seen since the start of the year. The portfolio was up 2.6% compared to my chosen benchmark the Vanguard FTSE All Share Accumulation fund which was up 2.7% over the same period.

Best performer for March goes to Manx Telecom (MANX), +19% following a takeover bid from Basalt Infrastructure. This is both pleasing and irritating as it's nice to see such an increase, it has only been in the portfolio since January. The bid has been endorsed by the Manx Telecom board so likely to be agreed at the AGM. I would have been happy to keep the shares, but will hang on in case there are any further bids, at least for another couple of weeks. Worst performer was Fulcrum Utilities (FCRM) -22%, again a new purchase - this time since February, but badly mistimed. I should have looked at the longer term trend which was clearly downward, catching falling knives always a risky business. Still a couple of recent FCRM announcements including a trading update have been positive.

Crypto

Cryptocurrency markets look like they have stabilised and could be picking up, and some of the crypto portfolio is moving into the green, plenty still underwater but it is time to take some profits before it all goes pear shaped again. Some nice returns on Binance coin, plus a more modest effort with OmiseGo, are the whales going to dump Bitcoin again, or have we actually seen the bottom this time?

Finances

On the personal finance front, savings accounts have once again moved provider. As usual introductory rates on existing accounts dropped away, leaving virtually zero interest. So they migrated again. It's really irritating to be penalised for loyalty from a bank...

On the cash front, both Mrs Sleepy and myself have bonus payments, Mrs Sleepy has share options maturing from her employer which have been cashed in, and I also have a nice dividend payment from existing shares with my own employer. The shares awarded by both of our employers are not included in the portfolio, I'm happy to take the dividends from my shares for the moment and will sell the shares at some point in order to reinvest in the portfolio. I see these shares as part of a "ring-fencing" strategy for the portfolio, which along with the emergency fund should ensure I won't have to dip into it at an time when prices are unfavourable.

Bonus cash will be split between the portfolio, the mortgage, a few jobs around the house, and a treat of course.

Sunday 7 April 2019

Friday 22 March 2019

Reckitt Benckiser

I rather like the owner’s manual that Terry Smith provides to investors

interested in his fund, it gives a clear explanation of his approach to investing.

I find myself attracted to this approach, and his results are impressive – according

to the Fundsmith website, from inception in November 2010 to February 2019 the

fund had generated a 302.5% total return, an annualised 18.2% growth.

I should probably invest in his fund and spend my time doing

something else, but I rather enjoy the process of analysing stocks. Since I’m

principally after defensive investments of the sort advocated by Mr Smith, I

thought I would take a look at a FTSE consumer goods stalwart, and part of the

Fundsmith portfolio – Reckitt Benckiser.

Reckitt Benckiser was formed in 1999 when the UK’s Reckitt

& Colman merged with the Dutch firm Benckiser. Over the years they have repositioned

their portfolio to focus on household, personal care and over the counter

healthcare products, including well known brands such as Calgon, Finish, Durex

and Strepsils (Thankfully in 2014 Reckitt Benckiser decided that the somewhat

cumbersome naming would be known as simply RB going forward). In 2017, RB acquired the infant formula maker Mead Johnson

and sold it’s remaining food brands to exit the food industry. It’s products

are sold in around 200 countries.

It has certainly proven a sound investment historically, £1000

invested in January 2009 would be worth £2847 (including dividends) in January

2019, an average return of 11% per year. Since I like a dividend, I’m also

pleased to see the dividends increasing by around 8% per year too, only 1 year

out of the last 10 was the dividend not increased. The dividend has also been

comfortably covered by free cash flow, averaging 2x FCF cover over the last ten

years. This has fallen from nearly 3x cover 10 years ago to below 2x more

recently, but I don’t see that as an issue, I suspect as the business has grown

and future growth looks more difficult to come it makes more sense to pass the

cash back to investors through the dividend.

Since the ceiling of any growth is revenues it’s good to

know that these too have been pretty consistently grown – although in 2014 saw

a 12% dip and 2015 they were flat, since 2009 they have grown from £7.7bn to £12.6bn,

a total of 62% or an annualised growth rate of around 5%. Adjusted earnings

have progressed at a similar rate, with adjusted earnings per share moving from

194.7 pence to 341.4 pence, a total increase of 75% or an annualised growth

rate of around 6%.

So the headline numbers above show that RB tick a number of

boxes, but before I invest some of my money into the business, I'd like to know how

effective is the business at turning that investment into profits? To try to

get a feel for this we should take a look at the capital invested, and the

returns on that capital (ROCE – Return On Capital Employed). Taking a

simplified view of capital as total assets – current liabilities we can see

that from 2009 to 2018 capital increased from £5.7bn to £30bn, that’s a 421% increase,

or over 40% per year. If we then take a look at their earnings before interest

and tax (EBIT – the other part of the ROCE calculation) we can see that over

the same 10 year period it increased from £1.9bn to £3bn, a 61% increase. So

investment in capital has significantly outpaced returns, an ROCE of 32.8% in

2009 has reduced to 10.1% in 2018.

|

| Return on capital employed |

The chart above shows these ROCE components and we can see

more clearly what has happened. From 2016 to 2017, assets rocketed whilst

liabilities increased a little, with EBIT also showing a slight increase.

This coincides with the acquisition of Mead Johnson for

$16.6bn (£12.3bn), which whilst contributing to earnings, has pushed up capital

far more and therefore brought the ROCE down. RB’s average ROCE over the last 10ys

is 22%, but that may not now be an accurate reflection of the business given the

downward move in the numbers over the past couple of years. Whilst RB work

through the Mead Johnson integration it’s probably reasonable to expect a hit

to business efficiency.

Another metric I like to check is net profit margin – net profits /

revenue, which effectively shows how much of every £ is actually profit, i.e. a

10% net margin tells me that for every £1 of revenue, the business has made 10p

profit. Obviously a higher number is better, it is a useful indicator of a

margin of safety should the business run into hard times – whether self

inflicted or as a result of the broader economy. Slim margins could leave the

business in trouble if they start to get eroded – nice fat margins would help

the business ride out those downturns. These average 24% over the past 10

years, most years being in the upper teens.

As well as the Mead Johnson acquisition increasing assets as

noted above, RB’s borrowings increased to fund the purchase:

|

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

|

EBIT (£m)

|

1891

|

2130

|

2395

|

2442

|

2345

|

2164

|

2241

|

2269

|

2737

|

3047

|

|

Borrowings (£m)

|

136

|

2644

|

2508

|

3274

|

2767

|

2572

|

2420

|

2389

|

12861

|

11879

|

|

Borrowings vs. EBIT

|

0.1

|

1.2

|

1.0

|

1.3

|

1.2

|

1.2

|

1.1

|

1.1

|

4.7

|

3.9

|

Debt as a multiple of EBIT was around 10% of earnings in

2009, and tracked roughly in line with earnings until 2016. But by 2017, after

the Mead Johnson purchase, had increased by £10bn and sat at a multiple of 4.7x

earnings in that year. A year later the debt has had £1bn sliced off, hopefully

new combined business will see increased inflows of cash which will enable the debt to

be managed, rather than becoming a burden.

With the announcement of the retirement of CEO Rakesh Kapoor earlier in the year the share price dipped, and the business will undoubtedly be subject to a little more turbulence as his successor

takes the reins and puts their stamp on the business. I’m hoping that as we approach the conclusion to chapter 1 of Brexit, in any stock market wobbles the share price of RB will take another dip. Working through it's acquisition of Mead Johnson, and managing it's increased borrowings has increased the risk of owning a slice of RB, but I think it looks like a decent long term investment. I'm off to learn more as it’s certainly on my radar.

Thursday 14 March 2019

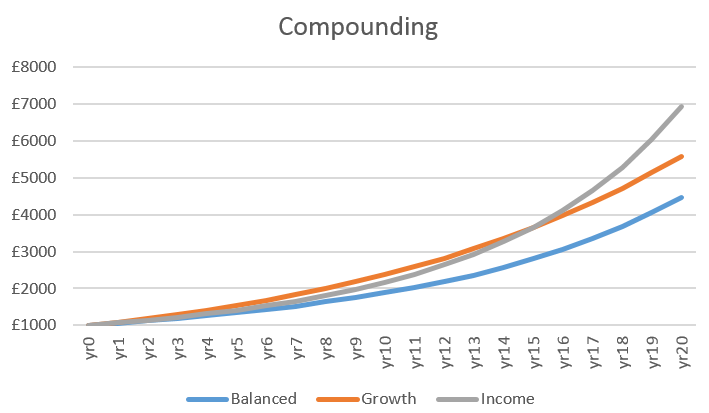

Compounding

There are plenty of articles and tools on the web to show

the importance of compounding when it comes to owning shares, but I like to try

to work through these things in my own way to try to get a better understanding

of them.

In order to do that I took three theoretical shares with

different “profiles” and indulged in a little time travel. Each of the shares

have an average “growth return” across share price growth, dividend yield and

dividend growth of 3.5%.

The first is a “balanced” stock, representing a business

growing slowly, generating a steady supply of spare cash to help grow the

business and also able to offer a reasonable dividend that it can grow

consistently. I think a suitable example would be Unilever or Diageo.

Stock 1: Balanced

Share price growth

|

3%

|

Dividend

|

3%

|

Dividend growth

|

5%

|

Average growth

|

3.5%

|

The second is a “growth” stock, representing a business wanting

to reinvest most of it’s spare cash back into the business, but still

maintaining a small dividend and little dividend growth. Examples of this type

would be Ocado, or NMC Health.

Stock 2: Growth

Share price growth

|

8%

|

Dividend

|

1%

|

Dividend growth

|

2%

|

Average

|

3.5%

|

The third is an “income” stock, representing a business that

is struggling to grow, but generating lots of cash that it returns to

shareholders as dividends. Maybe the zero % growth looks odd, but lets assume

the price oscillates around a central

point. I think businesses such as Shell or HSBC would fall into this category.

Stock 3: Income

Share price growth

|

0%

|

Dividend

|

7%

|

Dividend growth

|

4%

|

Average

|

3.5%

|

My investment into each of the above businesses is £1000, which is untouched for 20 years. Over that time, all dividend payments are

reinvested by buying more shares of the same business. To make life

easier, I’m assuming no taxes, and no transaction fees.

Clearly no stock would rise by the same amount each year,

there would be ups and downs, maybe dividend cuts, or additional payments. As

the fictional “growth” business grows it’s rate of growth would slow…there are

all sorts of caveats that could be built in, but I’m not going to because it’s

a nice tidy thought experiment…

The results are interesting:

Balanced

|

Growth

|

Income

|

|

Total change

|

348%

|

459%

|

593%

|

Annualised total return

|

7.8%

|

9.0%

|

10.2%

|

|

| share price compounding experiment |

So what’s my conclusion – look for a big dividend?

As most commentators tell us, the dividend has to be sustainable.

This is even more evident once the time span is stretched out to 20 years, and yet more if the share

price isn’t going anywhere. So how do we get sustainable dividends – by buying

into well managed businesses. But also businesses that should be able to continue chugging away indefinitely.

My conclusion, quality businesses are the target, not any

particular business “profile”. If I invest in quality, I can sleep at night, in

fact I’d like to think that I can just buy the shares and forget about them.

I’m not convinced everything in my portfolio is a quality

investment, but thankfully I’m comfortable that my main investments are. Whenever

I check my portfolio, I’m always drawn to those shares I’m not confident in. I often

forget to check those quality businesses, but whenever I do, I usually find they

are slowly but surely increasing in value.

Friday 8 March 2019

February Portfolio and Purchases

I was sitting on my hands until later in the month to see if the Brexit voting moved any of the prices of the shares I'm interested in - it did, a little. Mainly I think due to a slight pickup in sterling here and there which brought down the price of a few multinationals on the FTSE100. There were also a load of businesses reporting over the last couple of weeks of February - again I was mostly in spectator mode as not a lot on the shopping list looked particularly cheap.

Portfolio

On the portfolio front, up over 3.6% in February compared to my chosen benchmark which increased 2.3% - the benchmark being the Vanguard FTSE All Share Accumulation that I'm taking as a proxy for the FTSE All Share. If I'm buying AIM shares, I should probably take a different benchmark, but this will do for now.

Gold star for best performer of the month goes to Lancashire Holdings (LRE), +17%. Jersey Electric (JEL) went the other way -3%, so is on the naughty step.

Just a small speculative buy this month, with an eye to the future:

February share purchase: FCRM

Back to the AIM this month, for Fulcrum Utility Services (FCRM). Fulcrum provide a range of services relating to gas and electricity connectivity, smart meters, but of more interest, electric vehicle charging points.They were listed on the AIM in 2009 and have a market cap of £100m.

The December interim results showed a continuing growth story, with an increased order book, increased revenues and a net cash position. They tick a number of boxes indicating continued growth, and nice to see an unused credit facility too. All of their business segments were showing increased revenue according to their interims.

I like the idea of investing in companies working to deliver cleaner energy solutions, including electric vehicles, hopefully we'll see the trend of increasing electric vehicle adoption continue. So Fulcrum get a thumbs up, as does their 4% dividend, also nice to see the board aiming for solid 2x dividend cover too. I'm expecting the markets to get a bit wobbly given the Brexit shenanigans in March, hopefully we'll see a few bargains pop up.

Portfolio

On the portfolio front, up over 3.6% in February compared to my chosen benchmark which increased 2.3% - the benchmark being the Vanguard FTSE All Share Accumulation that I'm taking as a proxy for the FTSE All Share. If I'm buying AIM shares, I should probably take a different benchmark, but this will do for now.

Gold star for best performer of the month goes to Lancashire Holdings (LRE), +17%. Jersey Electric (JEL) went the other way -3%, so is on the naughty step.

Just a small speculative buy this month, with an eye to the future:

February share purchase: FCRM

Back to the AIM this month, for Fulcrum Utility Services (FCRM). Fulcrum provide a range of services relating to gas and electricity connectivity, smart meters, but of more interest, electric vehicle charging points.They were listed on the AIM in 2009 and have a market cap of £100m.

The December interim results showed a continuing growth story, with an increased order book, increased revenues and a net cash position. They tick a number of boxes indicating continued growth, and nice to see an unused credit facility too. All of their business segments were showing increased revenue according to their interims.

I like the idea of investing in companies working to deliver cleaner energy solutions, including electric vehicles, hopefully we'll see the trend of increasing electric vehicle adoption continue. So Fulcrum get a thumbs up, as does their 4% dividend, also nice to see the board aiming for solid 2x dividend cover too. I'm expecting the markets to get a bit wobbly given the Brexit shenanigans in March, hopefully we'll see a few bargains pop up.

Monday 4 March 2019

Reinventing the wheel

Whilst browsing the internet on a rainy afternoon I read an interesting article from Moneyobserver, indicating which funds they have consistently viewed as highly rated over the last 6 years - the date at which they started a shortlist of rated funds. It got me wondering whether these highly rated funds and their managers were all invested in the same small pool of businesses, or whether they were all heading off in different directions.

If I assume that all fund managers have at least a rather generic goal of trying to increase the value of their holdings, if there are great similarities in their portfolios, maybe I could take a leaf from their books.

But which funds?...a rummage on moneyobserver gave me a few options so I selected a basket from the following pages:

https://www.moneyobserver.com/which-rated-funds-have-kept-their-rated-stamp-our-shortlist-was-launched

The UK and global (not-emerging markets) categories here:

https://www.moneyobserver.com/money-observer-2018-fund-awards-performance-and-reliability-winning-mix

And the top 10 best performing funds over 5yrs from here:

https://www.moneyobserver.com/money-observer-rated-funds?sort=desc&order=Perf.%205Y

That gave me an initial group of 46 funds, with 3 duplicates, leaving 43 to play with.

And to make this a little more manageable:

If I assume that all fund managers have at least a rather generic goal of trying to increase the value of their holdings, if there are great similarities in their portfolios, maybe I could take a leaf from their books.

But which funds?...a rummage on moneyobserver gave me a few options so I selected a basket from the following pages:

https://www.moneyobserver.com/which-rated-funds-have-kept-their-rated-stamp-our-shortlist-was-launched

The UK and global (not-emerging markets) categories here:

https://www.moneyobserver.com/money-observer-2018-fund-awards-performance-and-reliability-winning-mix

And the top 10 best performing funds over 5yrs from here:

https://www.moneyobserver.com/money-observer-rated-funds?sort=desc&order=Perf.%205Y

That gave me an initial group of 46 funds, with 3 duplicates, leaving 43 to play with.

And to make this a little more manageable:

- include only the top 10 holdings in each fund

- include only only those businesses listed on the FTSE

- ignore % of the fund portfolio allocated to that equity

Rather than try to navigate the webpages of each fund I used Hargreaves Lansdown to grab the top 10 holdings of each fund to make life easier.

Once I removed funds without any FTSE listed holdings in their top 10 I had the following 24 funds:

AXA Framlington monthly income

|

Bailie Gifford global income growth

|

Bankers it

|

Barclays UK lower cap

|

CFP SDL Buffetology

|

Franklin UK rising dividends

|

Impax environmental markets it

|

JPMorgan uk strategic equity fund

|

Jupiter European opps it

|

Jupiter UK smaller companies

|

Lindsell Train Global Equity

|

Man GLG uk income

|

Marlborough UK micro cap grth

|

Marlborough UK multicap growth

|

MI Metropolis values

|

Newton global income

|

Royal London sust world trust

|

Slater recovery

|

Sli global companies

|

Threadneedle mthly extra income

|

Threadneedle UK equity income

|

TM Cavendish aim

|

Troy income & growth

|

Witan it

|

A few familiar names, and a sprinkling of the esoteric. The Threadneedle funds had the same Top 10, albeit with different weightings, so I dispensed with one of them. It did strike me that it was a bit cheeky to run two funds with the same holdings...

Next, I took the complete list of different shares, 93 different businesses in total, removed duplicates and counted the number of times each appears in a fund. Those that appear in more than one fund are below:

Business

|

No. Funds

|

Royal Dutch Shell

|

7

|

GlaxoSmithKline

|

6

|

Diageo

|

5

|

Unilever

|

5

|

Lloyds Banking Group

|

4

|

RELX

|

4

|

Experian

|

4

|

AstraZeneca

|

4

|

BP

|

4

|

Imperial Brands

|

3

|

Craneware

|

3

|

HSBC

|

3

|

Prudential

|

3

|

British American Tobacco

|

3

|

Rentokil Initial

|

2

|

Phoenix Group Holdings

|

2

|

Reckitt Benckiser Group

|

2

|

London Stock Exchange Group

|

2

|

RWS Holdings

|

2

|

Rio Tinto

|

2

|

Bellway

|

2

|

Homeserve

|

2

|

Dart Group

|

2

|

JD Sports Fashion

|

2

|

Smith (DS)

|

2

|

AB Dynamics

|

2

|

Serica Energy

|

2

|

If I was using this as a basis for my portfolio, I would remove the banks and mining companies, simply because I don't understand them. I don't claim to know how each of these work, but I don't rate my changes of accurately estimating the leverage risks associated with HSBC, or the direction of the global commodity markets that drive Rio Tinto's revenues. Perhaps obviously there are most of the largest names in the FTSE 100 topping the list, makes me wonder why you'd pay a management fee to someone to buy these for you when it's easy enough to do it yourself.

Still, there are a couple of interesting businesses in there. Food for thought.

Still, there are a couple of interesting businesses in there. Food for thought.

Monday 25 February 2019

Stock analysis: Telecoms

There has

been a lot of noise about impending economic uncertainty, and likely stock

market volatility so where might some of this roller coaster be avoided? Nice

safe defensive stocks maybe? They don’t come much more defensive than utility/energy

companies – providers of water, electricity etc. However, these come with

increasing regulatory oversight, potentially squeezing profits, and the current

Labour party have indicated a desire to nationalise such businesses. Another

sector that has very similar defensive characteristics without the same

restrictions and risks is telecoms – providers of mobile and internet

infrastructure. Today these provide a service considered indispensable by most,

so should have a very dependable income, and hopefully a nice safe investment. Lets find out.

There are 2 telecoms

businesses listed on the FTSE 100:

And 2 listed

on the FTSE 250:

Telecom Plus also provide a range of energy services so at least part of their

business may end up subject to similar regulatory and political risks as other

utilities/energy providers, and since nearly 80% of their 2018 revenue was

generated by their Electricity and Gas segments I’m excluding them. They do,

however, have a very interesting low capital business model, so I’ll be taking

a closer look at them at some point. (If you're wondering why the link for TEP takes you to utilitywarehouse.co.uk, scroll to the bottom of the webpage and you'll see that it is a subsidiary of TEP.)

There are other telecoms businesses out there of course, I bought a few shares of MANX last month, but to keep this manageable I will start with these bigger businesses.

There are other telecoms businesses out there of course, I bought a few shares of MANX last month, but to keep this manageable I will start with these bigger businesses.

So, Vodafone,

BT, and Talktalk... lets crunch a few numbers and see if any of them merit a

closer look.

How big?

Since these 3 live in different indices, or in different parts of the same, let's first check out their respective sizes:

How big?

Since these 3 live in different indices, or in different parts of the same, let's first check out their respective sizes:

In terms of size (24th Feb 2019):

Market Capitalisation

|

revenue

|

employees

|

% rev per employee

| |

BT Group

|

£22629m

|

£23723m

| 105800 |

0.0009%

|

Talktalk

|

£1123m

|

£1708m

|

2226

|

0.0449%

|

Vodafone

|

£37889m

|

£41214m (€46571m)

| 104000 |

0.001%

|

For all financials I’ve taken the last 10yrs published accounts, from 2009 to 2018. It would be no fun if all 3 companies reported in sterling, so Vodafone report in Euros, so I’ve translated everything back into sterling using historical average exchange rates taken from here

Vodafone is clearly the largest company here, in terms of market cap or revenue. Both Vodafone and BT Group dwarf Talktalk in most cash and valuation measures, not to mention geographic coverage, however, Talktalk generates significantly more revenue per employee. Does this mean we have a hare and a couple of tortoises here? What would an historic investment in any of these companies have returned?

Don't look back in anger...

£1000 invested in these businesses 10yrs ago would have generated the following return (including dividends):

|

| BT, Talktalk, Vodafone Historical Investment |

Well that's not overly inspiring. An investment in Talktalk would have peaked in 2015, and BT around 2016, dropping ever since. Vodafone was plugging away until last year, when it too decided to roll over. The best of the bunch is BT, which would have made a healthy 275% if you'd sold at the top (including dividend payouts).

Capital

|

Total dividends

|

Total return

|

|

BT Group

|

1713

|

768

|

2481

|

Talktalk

|

920

|

851

|

1771

|

Vodafone

|

1097

|

760

|

1857

|

|

| Talktalk revenue, profit, fcf |

Maybe these have been some lean years for Talktalk (admittedly that's a lot of lean years). let's give them the benefit of the doubt, maybe it's all about to turn itself around. So let's take a quick look at Return on Capital Employed (ROCE), one of the preferred measures of how effective the business is at making money:

|

| BT, Talktalk, Vodafone ROCE |

|

| BT, Talktalk, Vodafone FCF/Dividend cover |

BT isn't doing much better either - at least from what we can see in the above ROCE and dividend cover. Steadily worsening ROCE, dividend cover heading the wrong way...But an investment here 10 years ago, if dividends are included, would have increased by nearly 150%, I wonder what are the chances of this repeating over the next 10 years.

Borrowed time?

BT are not comparing favourably on efficiency (ROCE) or dividend security (FCF dividend cover). Do they at least have a well managed balance sheet?

|

| BT, Vodafone debt vs. income |

|

| BT balance sheet pension deficit |

|

| BT pension repayment |

And then there was 1

I was hoping Telecoms would provide me with a few options of nice safe, steady income stocks. Two of the three business above I certainly wouldn't view as a "safe" investment. So is Vodafone any better? The share price dropped around 30% in 2018, pushing the dividend yield up to over 9% at the time of writing, which I have to admit is tempting. Since the share price has dropped, is it a bargain? Or cheap for a reason?

|

| Vodafone revenue, profit and fcf |

|

| Vodafone share price |

Subscribe to:

Posts (Atom)